..the follow up on TRT

Saturday, September 23, 2006 at 11:48AM

Saturday, September 23, 2006 at 11:48AM We couldn't have been more impressed with this unknown thinly traded tech yesterday. First was the open, a little stalled because of the trade imbalance but perfect in the 8.5 range without exuberance to take it higher..good job AMEX. This provided a excellent opportunity to begin a position for many, the volume dictated there was going to be some interest to last the day. We are impressed by the interns at briefingcom that scour the trading underworld;)... the countless email suggestions only took a few hours to get a column up on TRT. We know this usually takes many days, weeks for the ones we put up over time on a undiscovered stock. Impressive was it didn't get the Briefing chasers to bid it up and leave you on Monday..again good job Amex guy for making so many shares available around $9. Now to the numbers, usually we look for sequential growth and not just look at .22 vs .02 YOY and say wow and jump in as some like to do. In this case it is noted that sequentially the numbers are on par to YOY #'s, so it was a go! There is a turnaround here clearly with nice revenue/EPS growth sequentially/YOY with growth doubling from product sales. I don't think you can find anything negative if you go deeper into the books but you're welcome to try. We like the China connection, we like the insider buying this year. If these shares were on the block at $9, we don't mind at all if it appears publicly soon. The tiny float, the volume and its accumulation under $9 was almost a perfect set for more to come. Yes, its hard to believe we are on a 3rd tech stock in 3 weeks but these are unknown small ones which fit into our books nicely and stay to form of our stock selection. If you believe here we go for a market spin downwards and it happens, TRT might hit a roadblock....we have seen many get stopped in their tracks just because of the timing of their stellar EPS...take that into consideration. This week has narrowed our hitlist to basically a watch list as many have hit their heads against recent high walls (WBD, UIC,CTCM)..all these need a sustained breakout to be traded again....others we sold off early in the week like GROW,AMIE have just fallen off after 25% DJIM moves and we very rarely feed on potential bounces..time will tell as will the question if SYX, SIM run for the roses resumes this upcoming week. So the list this week will be small but you never know when a new one will appear on DJIM...we hope TRT is this weeks special on the heels of the new entries to DJIM over the last 3-4 weeks. Quality over quantity here!.

Jon

Jon

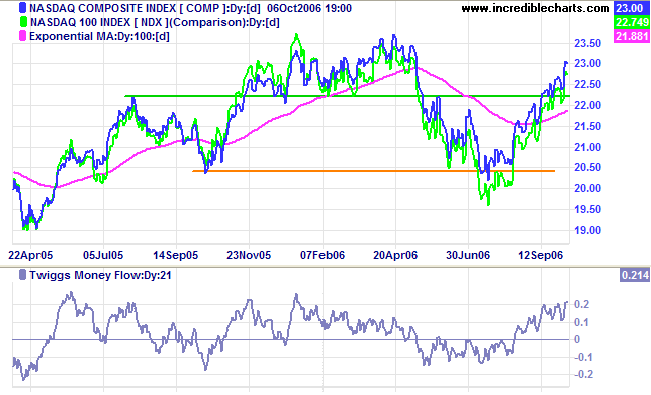

To sum it up, TRT is exactly the kind of small cap play we are looking for given the events that took place on Friday 22nd. We believe that this stock could be the first major winner of this fall quarter. It may be a semiconductor company, but the earning speaks for itself and more importantly, action suggests the stock is in play for a movement up. Then there's this 2.2 million float. It is imperitve for a small cap to have a tiny float in order to run like a champ. Between me and demi, we practically have played every single small cap runner that had a tiny float within the past few years. The most satisfying runners, are of course the ones that were triggered by a suprise upside earnings quarter. Now this co. may not deliver another impressive, growth oriented quarter like they did this time, but we are really tryiing to only play out the psychological thinking for the next couple of months. In another word, we are trying to play the expectation for the next earning report. This also brings to another point where this co. has no analyst coverage and very low institutional sponsorship. The advantage of that is that you can run your wild guess on the co.'s growth and earning estimate for next q, next year and etc. DJIM bought quite a few shrs of TRT on Friday and will trade it very aggressively in the coming weeks. We feel that even though the mkt is sluggish, but it's hard to imagine the mkt would crash at the beginning of an earning season.