..stalling too long

Friday, July 30, 2010 at 07:00AM

Friday, July 30, 2010 at 07:00AM The expectation of a dip since early Tuesday morning is getting a bit tiresome due to the action today. It’s getting a bit too long in the tooth and there is no solace in today’s mid-day rally or the fact the market managed to close above what should be a short term ‘floor’ at ~1098. The ‘floor’ seems a little squeaky and you can start seeing downstairs (1080’s) through some cracks. A close above today’s close is a necessity now for Friday (need to see some conviction dip buying show up), otherwise any disappointment over China’s weeeknd PMI’s and/or US ISM on Monday will cause a roll down the stairs to test the 1080's levels quickly. Market's resiliency will probably be tested tomorrow, if buyer's don't show up before the macro data next week.

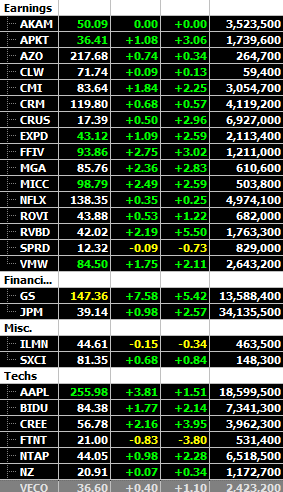

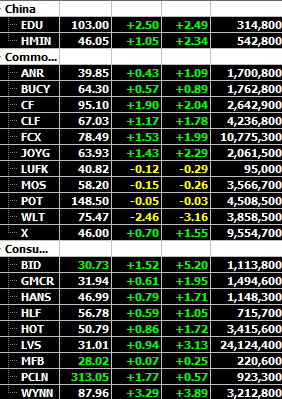

Being underinvested after Tuesday’s 1118 alert avoids any real worrying of the above happening, yet trading goes on slowly and it includes being ‘selective’ in picking out some current earnings and sticking with them and/or buying them on dips. These stocks have ‘underlying’ earnings that should avoid any ‘hits’ a high beta stock or sector such as commodities may experience in a further pullback.

A couple more of these earnings in the last 24hrs, include DJIM stocks past and present. BMO, we had VCI, CLW. AMC, we have DLB with excellent #’s and ROVI again not disappointing. These companies keep producing Q after Q. Tonight’s EPS#’s in high beta closely followed names like APKT, WYNN, CSTR, even FSLR are very ‘noisy’ and hard to gauge immediately off the headline revenue and/or EPS beat. The reactions are more of the profit taking unfolding we alluded to after VECO that is still presiding over the momentum ‘popular’ stocks.

Demi/ YourPersonalTrader |

Demi/ YourPersonalTrader |  Print Article |

Print Article |  Email Article | tagged

Email Article | tagged  APKT,

APKT,  CLW,

CLW,  DLB,

DLB,  ROVI,

ROVI,  VCI,

VCI,  WYNN

WYNN