Sober up time coming?

Tuesday, January 6, 2009 at 08:19AM

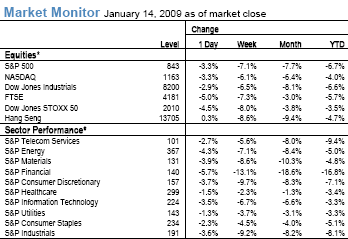

Tuesday, January 6, 2009 at 08:19AM Those coming back to the market and now finding the SPX up nearly 20% (from 11/20) didn’t help the market sober up from it’s holiday cheer. Despite new potential tax cuts of 300bln + , we still opened weak and finished in the red. (We had a test of 918-919SPX early and rebounded). The market was generally flat tape with exuberance for bargain shopping evident throughout our previously shadow-listed commodity stocks. Again, we saw beaten down prices of Shippers, coal, solars get eaten up, while the E & P Shales continued their merry way with Oil climbing closer to $50 ( some of this also b/c of a XOM for CHK rumor). All this with a strong $USD should have brought commodity equities down as it did with the price of gold. Instead, we just got more and more buying of equities on sale from 2008 inventory as those coming late are seemingly chasing ahead of any news from Washington.

At his point, it seems best not to fight the positive tape, even geopolitical tensions are being ignored as markets worldwide keep rising. But, we think it is just a matter of time before analysts get back to their desks and start cutting many sectors/ equities on valuation such as the Solars, Shippers to bring them back to reality. AMC, MOS (Chem-AG’) reported and should trade down sector, but AH’s is no indication of that happening. We’d say wait for firms to have a say and than see the reaction. Based on below-consensus 2Q:F09 and EPS and the negative near-term EPS implications of planned production cuts, profit taking should occur. Persistent weak customer demand is seen and the company is reducing its potash production by up to one million tonnes in the second half of F2009 and reieterated its willingness to further reduce phosphate production up to one million tonnes through F2009.

We think a sobriety test from the holiday mode is just around the corner and we’re looking for short candidates in the sectors above.

Volume still not back to normal levels.