Month End.."Top kill" it!

Friday, May 28, 2010 at 06:15AM

Friday, May 28, 2010 at 06:15AM Even though it's only been FIVE trading days where we traded below SPX1100, already, people are talking about SPX 1095 followed by 1104/200ma, as if it's the biggest technical resistance of the year!. It's true, we made no less than three attempts at 1095 in last few days and every time we just get rolled over hard to the down side. The downside, it seems, can be so devastating once the momentum reverses. We have witnessed a drop of 50+ SPX points in matter of hours when "machines" take over control of our trading activity. However, today it feels like it's business as usual with the "month end" fund buying globally.

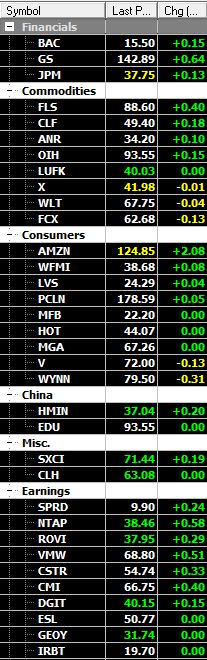

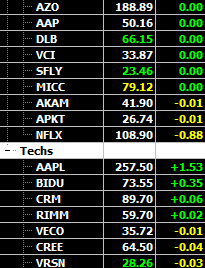

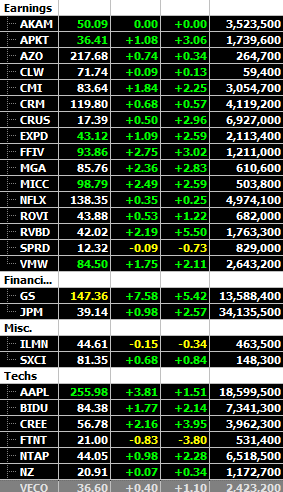

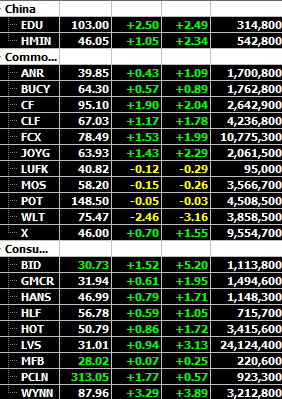

How can we even tell if it's fund buying and not short covering? Well, we can't be for certain, but we are going with the month end fund buying anyway as it was a global climb that started at 3am and just continued as steady can be.! Too many overnight points with no amazing catalyst had many scratching their heads. Basically, trying to pinpoint any hourly move with a legitimate reason is futile as the market is running on emotion. If media says this is the reason we are getting a selloff or rally, who are we to argue? In any case, the volatility in this market last few days may have driven people's emotion into untested territory. So, we'll just take today's 35 pt rally in SPX as is. What can you do on a day like this? Simply put, you'll have to participate even if most of the points (26 by 7am) are done with while we’re in bed. We are not talking about chasing stuff throughout the day, we meant you have to stick your toe in the market when everything was getting sold left and right last few days as discussed. If you were simply watching and cheering the fact you weren't hurt by the volatility by not be involved in the market, then we don't imagine you'd be too happy after seeing today's action. Just to put it in perspective, we merely cleared SPX 1100 and we are still significantly down from the recent high. What we are really hoping for is that we've seen the low for the time being so we know where to pick a point of reference to trade our favourite plays. A few recent ones like SPRD, SXCI were making new 52wk highs.

We have another trading before the long weekend kicks off and a new month starts. In a way, we'd like to see this month over as soon as possible in a quiet whimper. It's been a very tiring and emotionally draining month for all of us and a long weekend is definitely what everyone deserves. In addition, we are hoping that the month of May gets most of the volatility out of the way and we begin June with some quieter action. After all, who really wants to keep an eye on market when the biggest event of the world (world cup soccer) is right around the corner?

Happy & Safe Holiday!