Live with it!.

Thursday, September 16, 2010 at 04:54AM

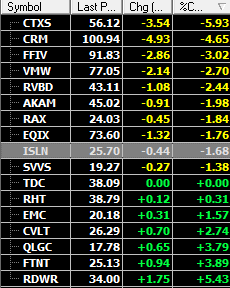

Thursday, September 16, 2010 at 04:54AM Oh, the disgust amongst Bears and shorts tonight after the late 30min ramp in the markets. Why would they expect anything less on a day when the FED fills 4bln into the coffers of sellers of treasuries that can now go buy something else?. Also, it’s clearly been a better to buy market with stocks having an underlying bid on dips, especially when technicals come into play. Anyways, we always enjoy the disgruntled tone and this sort of action, even if it was just a ES/ ETF trade for the most part with DJIM shadow listed stocks basically flat on the day. A few days ago, DJIM closely followed stocks and their NCH’s were posted, clearly these stocks ran before this market inch by inch move to fresh highs mid week.

As expressed last night ignore the QE2 noise / why all safe assets are running in tandem as yesterdays trade would end shortly and all explanations would be worthless. All you we need to know is..‘equities are better to buy’ as has been the theme in the 10 trading days of September. The ‘all we go up’ trade noted fizzled 24 hours later.

A possible myth in the market is if SPX1130 resolved to the upside, it will get traders/investors active again. Yes, “PA”,..some performance anxiety will hit, but it already has as noted if a break of April-Aug down trendline occurred. We’re not getting the 30% loss in volume from last year back overnight on a catalyst free breakout. So, even if this summer’s nightmare range is resolved shortly, it’s breaking out to the upside is really no biggie as it’s not going to be a wild rush in. Hate pointing old stuff out, but remember breakouts are not of years gone by in the major indicies. Instead, breakouts have been of the grind you Bears /shorts to death over days and days/weeks.

Recall, a market top call this year because of the turn in X first in April. The last few days have included warnings from Steels..NUE, STLD AKS for Q3. We don’t think this is another top. Just throwing this in as fear mongering is abound after these warnings. This weekend’s edition overview of week ahead has gone to plan with China data/Basel/BBY-CSCO playing their part and brings us to Thursday’s watch on FDX . Considering the market action this week, watch if a good report gets sold off after a move higher as it could signal a broader market move for the day.

Simply, if 1130 is gonna fall or fail, it’s going to do it without much fanfare on this side. The trade has already taken place with DJIM list as a lead. If our list is foreshadowing a temporary top with steels, it will only be a buyable pullback. It may be best to wait for the outcome of 1130 as most of the heavy movers are already pausing and pick them back up around 9ema ( like note here for Sept 8th trade when FTNT kissed 9ema at 20.30 and moved 15% in 5 days). This pertains to recent movers like GMCR, RVBD types and of course, excludes commodity linked stocks.