What's in the future?

Thursday, February 4, 2010 at 07:59AM

Thursday, February 4, 2010 at 07:59AM

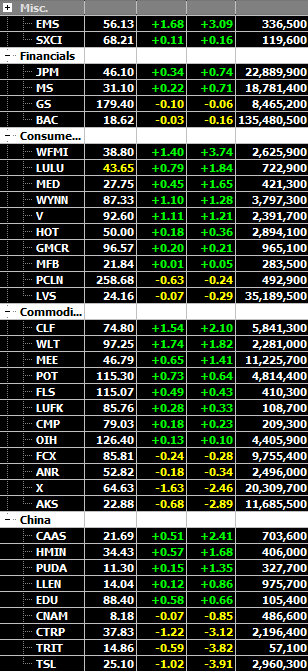

A month into the new year, with the big earnings peak behind us now, we are wondering what is going to happen to this market the next short while. Although the longer term view is pretty much the same regardless what happened during the past few weeks, most of us are wondering what plays/sectors will become attractive this Q.

It's almost inevitable that we'd get some retracement/ consolidation after the two strong trading days that started the week. With no buyers or sellers around today, it would make sense all parties are waiting to see if a retracement gets some steam and holds near recent lows. In any case, we have to be prepared either for some more downside, some ranged trading or some upside. Ummm, it sounds like we are "good" fortune tellers, right? Kidding aside, we are currently in a situation where only the market can give us a better clue where it will take us, short term wise. In our view, we'd be glad to have some sideway action in order for our plays to establish stronger support. A lot of the technical damage was done during the latest sell off, so it's imperative for many plays to settle down and have some strong hands to get involved in the stock and push over 9ema. At the same time, we have been particularly surprised by the strength of the corporate earnings front, especially from the technology sector. Now, whether people do even pay attention to those earning reports or not is a different story, we are just here to point out the stuff that will matter sooner or later.

But…More importantly now and we're 'bolding' this on site…

Unfortunately, now Bear momentum is gaining for this to become ‘Year of the PIIGS” early on and it has nothing to do with Chinese zodiac. Greece mess up is one thing, but when you start to throw in Portugal, Spain as they are starting today..be careful!. This didn’t just start in 2010, just as US crisis didn’t start in ‘08 with Lehman BSC, but in ‘07.…so if this is gaining steam we all better be careful till some clarity emerges. The problem here is this isn’t in our time zone and you’ll have deal with uncertainty to wake with in regards to your stock book, we had the US crisis before us on CNBC minute after minute making it easier to deal with.

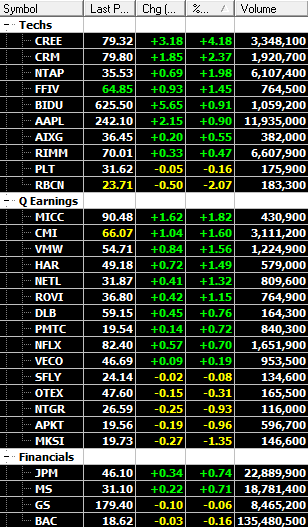

In after hour action, CSCO came out with a report/guidance that appear to be very strong as many of the other ‘big‘ names this Q. Can it be enough to get the market over 1105? Probably not as tech reports are not exciting to investors to move forward so far. Also, we have NFP on Friday to test sentiment. However, we do want to point out that those tech companies that have been recently cheered or is jeered by investors due to their strong earning are still within the striking distance of recent high should be on trader's radar going forward.

Also, MKSI, a small tech company, came out with report that beat the estimate by a big margin and raised their next quarter's estimate by quite a bit. This is also the type of earning surprise we'd like to see and we’d put it on your trading list.

Bottom line, market may need few more days/ weeks to pick a direction but we have to prepare in advance.