...upside risk coming back slowly

Tuesday, March 2, 2010 at 07:33AM

Tuesday, March 2, 2010 at 07:33AM After breaking the string of lower highs closes on Friday, the market woke up to be powered out of the gate by a string of M&A activity worth about 50bln + more Greece aid package noise to close at flush levels of 1115 SPX, we discussed last week. This is just above the 7 day recent range and if a good ‘breadth ‘ day is indication, as many times it is for a few days more, the risk is upside and those conviction buyers may have reason to step off the sidelines as the shorts will keep their distance. What’s good about the ‘ breadth’ is even the big momo laggards got in the action..AAPL, AMZN. This appetite for techs helped propel the SOX over the 50ma after trying unsuccessfully last week.

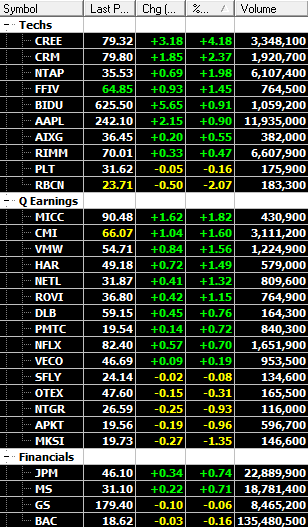

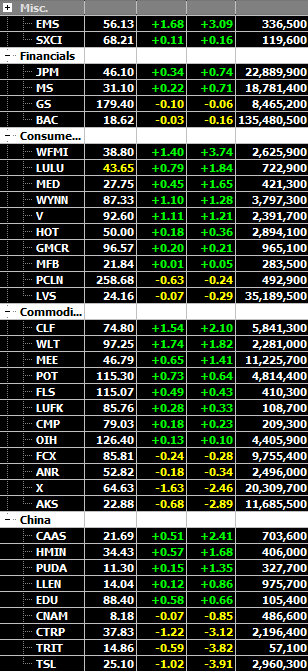

Of course, the financials are always the disconnect from the market tape it seems. Last week they outperformed the tape, today they stunk the joint out. Well, we’ve learned the past 6 months or so that GS and the boys are not greatest barometer of the tape, so it’s no big deal. If we follow our shadowlist names and set it up as we did in our last update, you know where the money flow is going and therefore what is the trade. We can see by the example below of where some of the flow was today and it was into our Q earnings plays. Some names noted in February off earnings enjoyed a NCH day…ie. WFMI MICC DLB NFLX PMTC