DJIM #34 2010

Monday, August 23, 2010 at 07:37AM

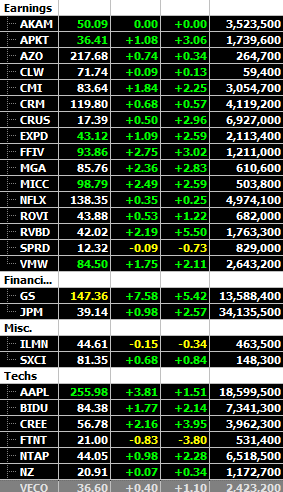

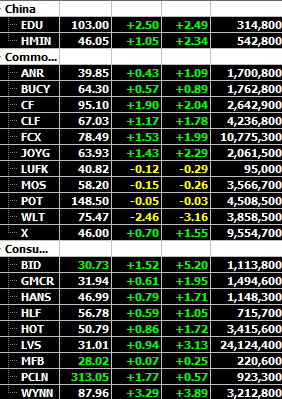

Monday, August 23, 2010 at 07:37AM Heading into a traditionally quiet summer holiday trading week, most are citing the market should get some reprieve from the July carry unwind trade that late last week was on the verge of giving back all of August gains in equities. Interestingly, these ‘trading ideas’ are contradictory to all those beliefs that the market is controlled by “machines” these days. So, throw in some Blackberry type gadgets and this market doesn’t necessarily have to take a week off at the ‘beach’…anything can happen as this is not Q2, but Q3 where the macro environment has deteriorated quickly, especially since the ‘initial job claims’ warning here came to fruition in step with NY/Phil manu numbers. The worst thing about unwinds is the speed they can occur in and HF’s have no mercy in liquidations, even in late month ends, late August past summers. Last week could have been the start as high beta continue to be sold off more. Best to stay ‘defensive’ until the USD finds some footing in hope no further strength occurs and takes equities down in lock step. Also, stay disciplined and watch for and trade what you know. Like Shadowlisted past earnings like CRM on Friday, if given the chance for some trades. It is so much easier to trade history (as in its been on list for over a year), but keep them on a short string and take profits in this rocky environment. This is the same story as with NFLX, VMW, FFIV types for over a year now on our Shadowlist. They have had the best numbers and they perform to those expectations in share price over and over again. Unfortunately, the reporting season is over and we’ll have to really dig at the potential plays. Maybe its secondary plays off M&A activity, like a little known FTNT noted here, which was strong on Friday..or play GMCR again as a play on souring coffee prices and SJM earnings…or a HANS, which will one day really breakout from these levels as it sits at 2009 and 2010 highs. If it’s trading Red Bull, coffee related or some unknown stock like FTNT in this unpredictable market, that’s just fine until things clear.

As the market unwinds from the July end Q reports, attention turns even more to the July ‘macro’ numbers (around the globe more this week), plus the markets attention will be turning to Friday’s address by Bernanke in hope of getting some light shed on what the FED did and why and what the eco‘/ deflation picture is looking like!

Demi/ YourPersonalTrader |

Demi/ YourPersonalTrader |  Print Article |

Print Article |  Email Article | tagged

Email Article | tagged  CRM,

CRM,  FFIV,

FFIV,  FTNT,

FTNT,  GMCR,

GMCR,  HANS,

HANS,  NFLX,

NFLX,  VMW

VMW