inching higher...

Thursday, January 7, 2010 at 04:38AM

Thursday, January 7, 2010 at 04:38AM The week’s grind continues to inch higher, even if today’s action is flat on paper end of day. The action is right on and expected, if we are in the midst of a rotation, a rotation which would signal a longer rally.

First, naturally the NASD, the big winner in Q4 tech is weak again today as some profits are locked up and put into financials. Second, the ‘big caps’ banking- broker/ stocks just had 2 big days and need to consolidate/ rest. (BKX >6% on week). The regional banks took over today as interest is broadening out (positive). Put these two factors together and the market doesn’t have the push today as these very important leader names take a breather!. We're not moving forward with stocks such as GOOG AAPL AMZN GS JPM BAC C all better for sale today. Even, a strong $CRX >2% off more upgrades in coal, steels, more dovish FED minutes on the day couldn't push the market over 1137-1138 channel top noted in yesterdays Journal. This is not a big "R"esitance, it's just there at an interesting time before the NFP/ report and earnings season and is therefore acting as a wall this week. The real "R" comes 1155-59 and that's where we're going if the S&P financials, eg.XLF, BKX, KBE, RKH can breakout which should coincide with a break of SPX1137-1138 and some chasing may begin. We noted a pullback in last journal would be a buy opp', still if we get a breakout from these financials ETF's it will be strong enough to chase. Short interest is back to August levels in the group and a squeeze is a possibility. Either way, exposure here is/ will be warranted.

Interesting bit out of today's trade were the initial negative reactions to earnings from MOS MON, but later both rallied as did the sector (NEU always in Ag Chem group) (CMP almost eeked out a day high of $74 after yesterdays notes at $68-69). Also, FDO in consumer sector squeezed some 12% because numbers were not as feared and WOR up 20% on a decent Q beat. This type of action may mean that once say eg. X reports and even has a big beat and/or excellent guidance this may all be priced in by than. This could be something to monitor in all sectors going forward, it may be a Q to get in early than after a report on a stock/ sector.

As far as our Casino, China plays..if the big boyz need a breather, so do these high flying/ high beta smaller stocks.

Demi/ YourPersonalTrader

Demi/ YourPersonalTrader

Theme same midday,

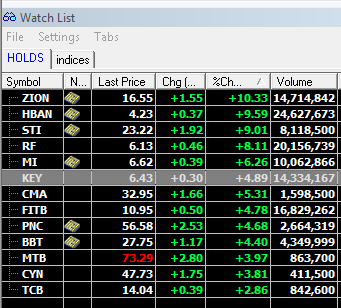

NASD weak (regular momo names leading down), Banks- Brokers..RKH (regional), $BKX ETF's up >2% while it's hard to find a quality name stocks >2%, even >1%. Basically an ETF financial trade market with single stocks not getting any conviction buying (yet). Noted strength spreading to regionals in Journal.

List of individual regional stocks performance below(site)