Day 5 ahead?

Friday, June 5, 2009 at 06:18AM

Friday, June 5, 2009 at 06:18AM We mailed in our request Wednesday afternoon for a bank-brokers led reversal and today it was stamped as the group followed through in the morning bringing along the rest of the SP tape. An impressive ~3% SP Financial rally tacked on to yesterdays 30 minute move accompanied by Crude (yesterdays E&P plays PVA GDP tagged along) and slowly commodity stocks began to bounce as the USD weakened. (becoming too closely related the USD moves). Was yesterday’s big sell off just the usual hiccup? Maybe, but Shippers stayed red into close. If all this action wasn’t your scene, the DJIM earnings/ story scene is enough as more Q’s plays, DDRX OGXI EJ (co’ cnbc guest) all had 10% -20% intraday rips higher. A few others were on the cusp of/ and breaking monthly/ recent highs EBS TSL SAFM ARUN. The buy pullback theme remains pretty clear on all DJIM plays. Basically with the majority of these you can use the ‘hit and run’ play by taking profits and switching between names while waiting for a pullback to get back in something you sold.

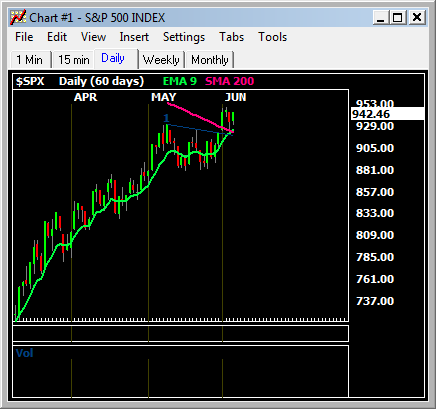

Chart: SPY move/ SPX reversal off 200ma

Once again the shorts are thwarted as they can’t get enough downside days to get cocky and initiate new positions to press the market lower, but this has been one of the bullet points we’ve pointing out since SPX ~800, so it’s nothing new!.

Ahead of NFP #'s tomorrow, we have a few things roaming in our crystal balls. As we know the ADP # (532K losses) handicaps the NFP (-520K consensus), so you’d expect a similar number, right!/?. Well, we’re feeling a little squirrelly and think we may get under 500k. Something also interesting is the Banks-Brokers, we’re seeing and using the XLF here. Considering the action in the group in the last few hours, if this is only the beginning of a move, it would soon be kissing the 200MA. The last time this occurred was in prehistoric times;)..2007!. So, is this the missing link to push the tape higher as most indices are over 200ma now?.

Oh yeah, we are moving into a possible day 5 with SPX over 200ma. This is crucial as this confirms for many the breakout, we‘d actually probably just prefer this occurring to close off the week to avoid excessive bullishness setting in and instead take baby steps.

Chart: DAY 5 SPX?