Earnings will matter...

Thursday, January 21, 2010 at 07:54AM

Thursday, January 21, 2010 at 07:54AM

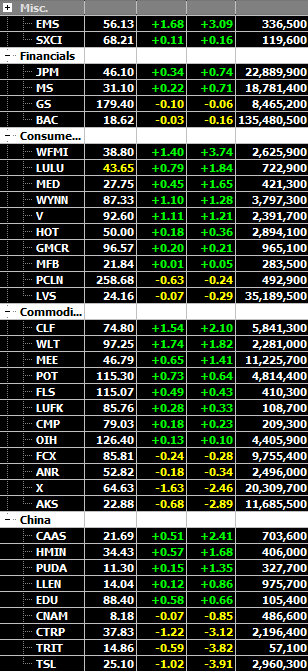

Honestly, it doesn't really matter what the negative headlines suggest, profit taking is all we need to know. Instead, media and analysts alike would love to pinpoint a couple of specific reasons for any day's decline. Well, it's their job. Today, rumor that China is tightening its lending is sending "shockwave;)" throughout the world before the release of all their Eco data tonight that is expected to show overheating of sorts. Ummm, unless we just heard it for the first time during last few months, we swear this is just recycled news. Yes, they will withdraw excess liquidity, let’s get used to it. (headlines). Also, there's always people who like to remind us that we've already had such a terrific run from last March and it's time for a meaningful pullback (again, eh). Well, we also like to remind people that this market has ran up so much since 1960s and it's time for a pullback now;). The point is, you have to have a pretty good idea about this market in order to dissect what news is helpful and what news isn’t these days.

We have literally entered the second week of an earning season and we'd like to think corporate earnings should dominate the news media. In our opinion, it should and it will! No matter what causes any little pullback, or in some people's opinion, healthy consolidation, we have to focus on what's more important. Do corporate earning suggest an Economic recovery?, if so, at what pace are we recovering. Here's the thing, we don't expect SPX to hit 1200 anytime soon and breaking over 1150-1160 would probably take some time without a “BIG’ catalyst. In 2009, we’d see SPX going 5-10% in either direction in a matter of weeks, sometimes days, but it’s just not likely going to happen in 2010. Why? Things have stabilized and people will invest/trade in a much more rational way than past few years. So, compared to last year, this year will give us this "grind" feel. This is just fine with us because it allows us to ultimately focus on our game, the earnings game!

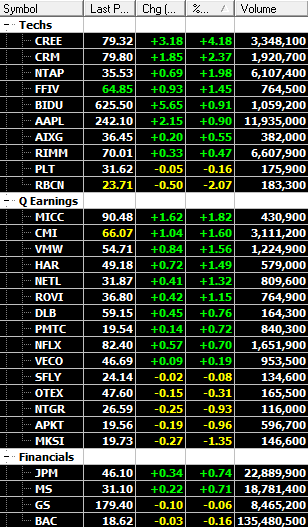

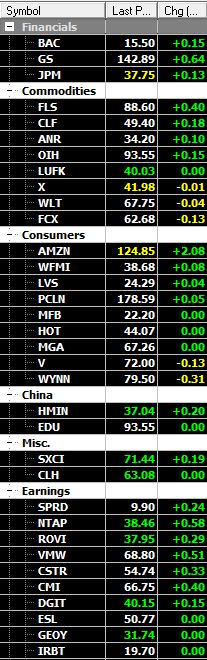

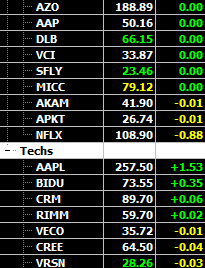

CREE, from last night, came out with an outstanding report/guidance as noted and was rewarded with some nice add on gains along with VECO,AIXG . This morning, many financial institutions have come out with reports that have exceeded expectation and are probably the main reasons we had a little comeback in the afternoon. In AMC today, names such as SBUX and STX, PLXS (add to list) all came out with quality reports, basically as many as 5-6 NASD/Tech (incl. FFIV on our list) did as well. So, trend is still pretty clear where this Economy is going. As long as people's favourite companies come out with good earnings, you can assign a reasonable P/E behind them which in turn will give a strong support to the overall market.

Bottom line, we may be in for some range trading (again, we bounced off ~1030 and closed on Nov trendline) until the assessment is clear that the market deserves a higher valuation. Majority of the companies have yet to report and their earnings are an absolute key to the health of this market. Forget about rate hikes or inflation because right now, it's just the excuse bears use to get out of their position.