A little promising...

Wednesday, May 26, 2010 at 06:47AM

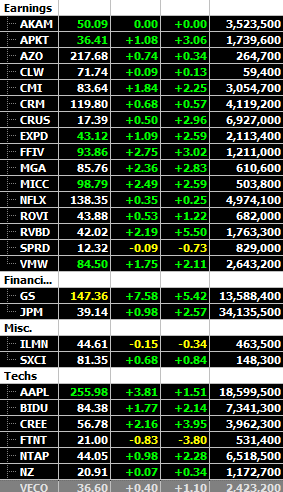

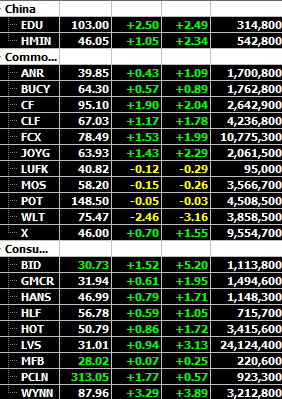

Wednesday, May 26, 2010 at 06:47AM Forget about the CC# that came in better than expected and forget about the nice EPS report by AZO (on heels of AAP, one of strongest groups), this market is totally emotionally driven with no concern about what the consumer thinks on the recovery front (CC# is labour vs. financial market weighted) or earnings at this point for a positive twist. Honestly, the best case for anyone who's playing on the long side is a massive gap down morning like today. Basically, when the market gaps down these many points on catalysts that are only emotional or none at all as the case was today (in addition to an already way oversold environment which equals Feb. Bounce low), what you end up having is the end result of today, a bounce off 1044 support. A nice rally, but one that came with no conviction on the morning selling or real afternoon conviction buying. We want to see follow through with not a lack of sellers, short covering, but one that has buyers chasing!!. That is conviction buying. This day could be promising, but does not prove anything yet.

So, does today mean the end of the slide and beginning of a huge rebound? Probably not! What it means is that unless the market's volatility eases, this is the kind of market action we'll continue to see on a daily basis. So when is the volatility going to ease? Well, nobody has the answer at the moment. What we do know, at this point, is that most of us are immune to the wild swing and 300 pt+ reversal these days. About a month ago, any day where the market drops over 100 pts on Dow, it kind of spooks people and a back to back drop of that many points was even unthinkable. This month, it seemed the world turned upside down as far as volatility is concerned. Believe it or not, the volume of SPY within the last two weeks is actually more than the two weeks of Feb. 2009 when the market went from SPX 800 to SPX 666. This goes to show the kind of action we are going through right now. Here's the good thing, the volatility will eventually die down and we are definitely closer now than a week ago. Perhaps, the long weekend that officially kicks off the summer season for traders can get this market to move in a quieter and more manageable fashion ending the ‘Mayfest’ .

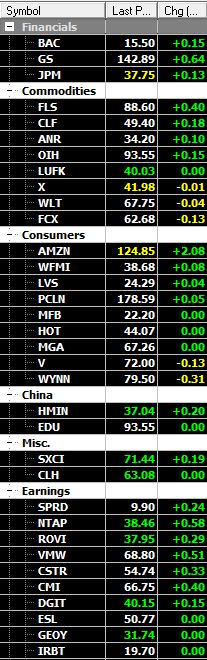

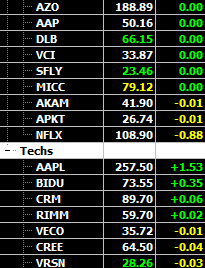

There are two things we want to point out though. Market's advance and reversal today has been led by Financials and Commodities. Why could this be important? Financials represent the area where people were backing off due to the European concern in the last couple of weeks. Commodities represent the area of Economic recovery for the world. Both are key representation of investors' sentiment. Well, it may not mean that much if we get another gap down next couple of days ,but we just wanted to point it out because some charts of the plays from above sectors look like they are ready to rebound.

Bottom line, regardless how the institutions play out their game, right now is a time to dip some toes on the long side. Whether we have more points on the downside from SPX is somewhat irrelevant at this point because looking at a lot of individual plays, the upside just looks way more appealing than the downside.