As the broad markets tumbled with enthusiasm dampened for QE all the way to SPX1173, (WSJ says the Fed will “unveil a program of Treasury bond purchases worth a few hundred billion dollars” over “several months”, the Fed is opting for a more measured approach vs. the initial “shock and awe” of QE1), DJIM traders should have hardly noticed, if following the premise layed out all week of fixating selective individual equities (earnings) vs. broad markets goings on.

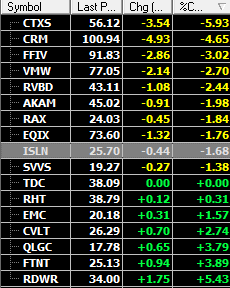

Yesterday, the lead into the trading consisted of 5 EPS linked stocks (CML (the highlight ,+30%), FFIV, ILMN, LIFE, EQIX) from the previous AMC. As noted, EPS stocks ‘have room to run’ after gaps premkt and/or post opening bell. Again this aspect pointed out early in the week worked again, notably with CML and FFIV, ILMN. Another on AMC off our list, LVS showed there is room to trade to higher after the initial bump off earnings. As far as the overall Virt-cloud/M&A gang shooting higher, remember this note following the huge sell off in the space.."To put this 'cloudy' day into perspective, ask one question. Do shorts or the acquiring executives at IBM, HPQ DELL, CSCO know better???. Easy answer, cloud is the only growth shift going on, besides anything smartphone related. One good report, one acquisition and it will be sunny and not cloudy days in the forecast".

This EPS has seen over 80% of reports beating expectations, but the macro/QE2/ FX trade is the number one issue today. Once again the early foucs was USD was stronger/ Euro weaker and the bond sell off continuing. By end of day, maybe some are finally getting drift that a strong USD/weaker Euro does not necessarily mean lower equity prices and that there is actually an allocation shift from TSY to equities to sustain the market as alluded to earlier this month as a possibility. This last minute Briefingcom day trader headline shows the bewilderment, a little too late for those shorts who tried to press the issue again early, only to be squeezed out again by the ‘resiliency.’ of this market…“Squeeze off the lows continues as we approach the close..The dollar is off its highs, but its pullback has not nearly been of the same magnitude as the bounce in stocks”.

What’s interesting now stems from what was noted here following the beige book which showed eco’ is getting better. Since, we’ve had some more good data points, including China/UK GDP numbers, better than expected earnings that is showing things are ‘stabilzatizing’ here and globally and thus QE2 is becoming less relevant in the size scope the market wanted days/weeks ago. The expectation today should be what ‘Bernanke’ likely leaked to WSJ to cool the enthusiasm beforehand and just maybe the equity market is not about to sell off on the news like the Bond market has judging by the reversal today. The more pressing issue for the broad indexes is the signs of tiredness at SPX1180’s for what seems like all of October now. All in all, this should not matter to how we all go about trading the market day to day with the noise getting more nauseating as we get closer to FOMC date. We can avoid this noise and not throwing up over ourselves and our accounts in case of a sell- off by staying selective in stock picking and by switching those names/taking profits as new oppy’s come up.

*Again you can follow additions to our Shadowlist by visiting the on site 'Playpen'.

http://www.djimstocks.com/djim-journal-2h-2010/2010/10/11/on-site-playpen.html

Monday, October 11, 2010 at 02:54PM

Monday, October 11, 2010 at 02:54PM

Demi/ YourPersonalTrader |

Demi/ YourPersonalTrader |  Print Article |

Print Article |  Email Article | tagged

Email Article | tagged  CVLT,

CVLT,  EQIX,

EQIX,  FFIV,

FFIV,  RAX,

RAX,  RDWR,

RDWR,  RVBD

RVBD