Hug me...I'm tired

Wednesday, June 3, 2009 at 06:29AM

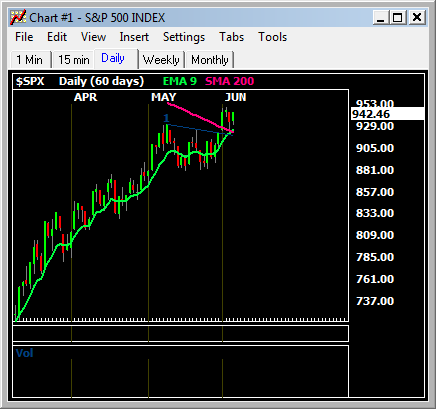

Wednesday, June 3, 2009 at 06:29AM That’s basically all the SPX said to the flatline today as the tape rested after ripping nearly 50 handles in a few hours the past few days. Surprisingly, the selling/ profit taking was very orderly, despite the second day of financials lagging. After a break of over a week on issuances, the banks- brokers began tossing new supply out due to new rules by Treasury to exit TARP. Shorts are trying to paint a picture of this lagging group in the advance as a fuse to breakdown, but it’s not working as the market is saying the banks-brokers got this rally started and it’s healthy that we can move 50 SPX handles and than rest today without their participation. Still, watch carefully if all this new supply and more becomes a noise 'concern'

One of the big leading groups has been the commodity linked stocks as the PMI #’s and a collapsing USD are responsible for the latest advance and the high beta group of stocks we follow surely would be the first to take a breather. If this is all the breathing space they need today, we’ll ..then we won’t get our welcomed pullback to buy cheaper. But, we doubt that. You have to be realistic here, no matter the PMI #’s forward look for the sectors, the USD has sunk about 12% from March highs and unless it’s dropped as the reserve currency overnight the equities can only rip so far before resting. The USD, strength in it will most likely put pressure on the linked equities, so we’ll wait for such to re-initiate positions.

Some defensive posturing was underway today, but as we said a few weeks ago when those disbelievers tried to get a defensive rotation going, we’d hang up the phone on you if you tried to request such from us. Look back now and see what you would have missed if you let Briefingcom and such to your talking for you at that point. “ garbage rally..signs of froth”, May 12th…The DJIM safety/ defensive trade has been a focus on earnings linked stocks, you may say.

http://www.djimstocks.com/djim-journal-09/2009/5/13/a-healthy-tape.html

Today gave an opportunity to look around and what we found was quite a few plays, only now possibly setting up for moves such as SAFM, ARUN that really didn’t participate in this latest rip because they have been consolidating their earning reports. Both pressed to 2009 NCH at close after notes today. The best rip and right out of the gate today was the 17% shuttle from CVLT , last Wednesday we alerted it as DDUP connection and today this was highlighted by a firm and led to the burst. A 25% move since. Again, this pinpoints selective stock picking, we think we have accumulated an excellent group in May that has been safe (meaning you’re not losing money holding) and with good pullbacks, they pay back well if you want to book profits. Of course, most are earning related.

On a group we haven’t covered for awhile is the Haynesville Shale grp, E&P stocks. GDP had very strong well results Monday night and stock outperformed energy linked stocks. PVA, last night had v.good drill as well and may react similarly off the bell. So, we'lll monitor this theme for any further potential in days to come as well.

If today is any indication of the next 2 days leading into the NFP -employment #'s, we`ll take it, but realistically after this rip we need to digest more than what we saw today and a stronger $USD (commods’) & possible concerns on more supply issuance by banks- brokers may provide such.