20MA recaptured

Wednesday, July 21, 2010 at 07:00AM

Wednesday, July 21, 2010 at 07:00AM Despite Friday’s swoon below our critical 20ma , we managed to eek back over it twice on Monday and today as soon as a 3rd try ensued, the market breezed through and staged an impressive reversal day closing 15pts above the 20ma. This has been the ’Bulls’ benchmark here and it remains so!. Looking at today’s action, we think the April/June/ July trendline that held the Bulls at bay last week is much more vulnerable now and should be easier to crack. So, what brought on today’s impressive comeback.

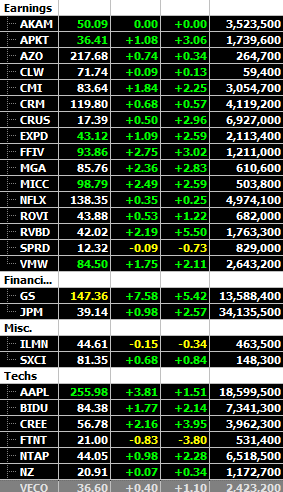

- Despite all the critique about disappointing 'revenue' lines in earnings, you can only beat a horse so bad after a gap down. A change that continued today was these gap down earnings beatings were getting ’bought’ up the last few days. Examples were HAS and DAL. Today, the same was happening early in IBM, GS early and in a smaller name CRUS , which raised revenue guidance, but was knocked down to mid 15’s(->10%) before climbing to flat and than a 5% gain by close. Simply, the market was overreaching the ‘revenue’ misses mostly and this proved to be buyers delight as they step up at these exaggerated gap downs.

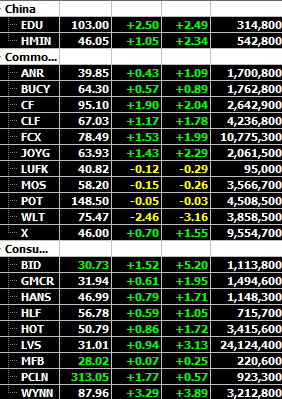

- If you have your DJIM shadlowlist set up like shown here, you could clearly something out of the ordinary early on. The commodity linked stocks were outperforming the market in a big way. Question was why?. As we all know if China goes, commods’ go. Considering the Shang was up 2%, (2 days straight), you knew there must be China talk. And, there was talk, talk of China ‘easing’ measures and also noise about better margins for the steel co’s in Q4 from China companies. Most importantly, Shang is over 20ma and should be watched as we could be off the ‘bottom’ in commodity linked stocks. We all know even when the overall market doesn’t give you gains, trading the commodity linked stocks is all we need if a trend is beginning. It could be a little early, but the train may be leaving the station and buying the pullbacks gradually is probably the way we're going to go now.

- Lastly, we asked for earnings ‘ammunition’ yesterday and without going into detail, we definitely got some from AAPL and VMW (nice chart set if trendline broken) to fight the Bears.