'Snow job' report?

Friday, March 5, 2010 at 07:19AM

Friday, March 5, 2010 at 07:19AM SPX1123 has been the theme the past few days here and guess what?. The market hit this mark by 10am and backed off and than struggled to stay green midday showcasing more of the tiredness signs. But, a last hour push up and guess what, we closed at 1123!. Just a wait and see market, no conviction buying, an underlying bid on any weakness and shorts afraid of upside risk. Market is shrugging off all negative data today as a ‘stormy weather’ excuse and is thinking the same for tomorrow’s NFP #. A bad number may work as an excuse (say it's worse (-100-140K) and market sells off, we'd be buyers most likely as an underlying bid on weakness should prevail. But guess what?. A surprise strong number and we likely gap!. Now, that might be a ‘snow job’ report. A combo today of a higher USD+ lower 2yrTSY may be the signal of such a surprise. Do we want this possibility?. Well, our concern is of a gap up that would be followed up by a sell on the news reaction possibility at these technical levels near 2010 highs. So, we’ll be watching for this, if a surprise number hits tomorrow, the chasing investor may get a snow job in the face if the market rolls over signalling the fatigue we’ve been talking past few days. Whatever up or down swings happen intraday off whatever type of NFP report, the last 30 minutes/close will be the thing to watch.

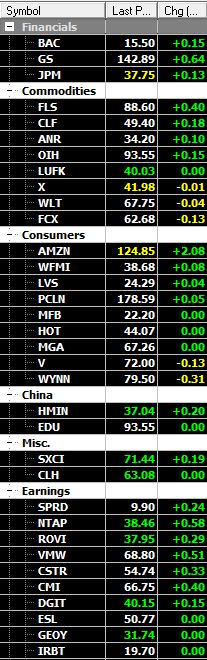

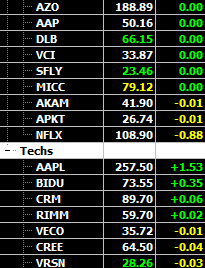

Broadly, the banks-brokers were strong as a good nights sleep seems to have abated the ‘DC’ fear from a day before. What side of the bed these guys wake up on tomorrow is another question!. The bond offering in Greece was simply over subscribed and so a relief, but, a bigger aid/ issue bond offering package is still an underlying question. Despite, what seems like a broad market whipsaw for a few days, earning plays are working well. Today Shadowlisted SXCI was the star, plus we are seeing some momo’ flow, which provides intraday opp’s or possibly longer term framed trades..ie TIVO, AAWW and CNAM today. Hopefully, the NFP# reaction does not derail this trend.