That's it?

Tuesday, March 23, 2010 at 07:53AM

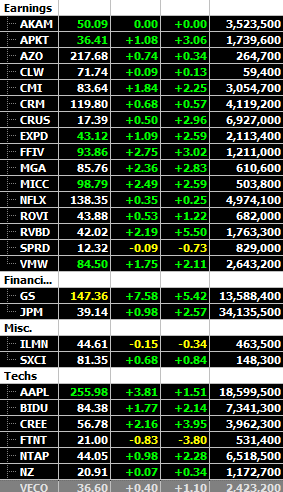

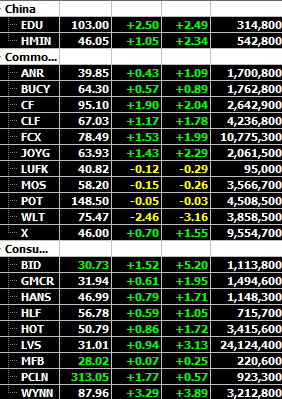

Tuesday, March 23, 2010 at 07:53AM Was that it?. Was the gap down to only 1153 SPX, the pullback/ consolidation before end of Q dressing, we’ve been discussing as a possibility into Q end. If that’s all there was, than it was quite impressive. “Performance Anxiety” was at it’s best and shorts were at their best running to cover at the first hint of today’s reversal after laying down some fresh positions over past few days, including some very early today. Waiting for a decent pullback seems to be a lost cause into Q end and earnings season unless an unexpected ‘catalyst’ hit’s the wires or familiar liquidation. “Worries” over China, Greece, and HCare today are just that…’worries’ that come and go on a daily basis and the market has started to deal with it, seemingly by finally believing in a recovery. The action in what we call consumer discretionary stocks was definitely present today as Casino’s did one of those regular Q squeezes on an upgrade/ some newsflow and Auto related stocks rode the ALV report. (HAR a shadow stock at B/O levels and MGA is where we look.

We all can crazy guessing where this market goes next, the nuances of the SPX, let’s not worry and continue to just concentrate on individual stocks selection and sectors. Even, not following the HC bill and the sectors involved, we still dug up a shadowlisted stock to play into the story, EMS last week on an alert on the story at $54-55 hit $61 today.

Two things can happen, the market can roam freely and grind higher till Q end on performance anxiety and /or even until early April when the next eco’ data of significance the NFP (next Friday) & AA-INTC earnings in reminiscent fashion of last Q or we get one of those big dreaded ‘liquidation’ moves from the hedgies we’ve seen more than once at Q end after a run-up. Again, let’s not worry either way by just not outweighing positions in numbers or size and take it (profits) where we can along the way and hope a move up/or down is not exaggerated for the sake of a future healthy market. As long as new highs are being confirmed on a seemingly daily basis from different indexes, the momentum grinder is in the Bulls hand.