Absorption

Tuesday, May 12, 2009 at 06:41AM

Tuesday, May 12, 2009 at 06:41AM Today's tape shouldn't come as a surprise. Not only did the banks- brokers leaders need to absorb last weeks gains, they also need to absorb their billions of capital offerings with the market.

Two of the prominent leaders in this rally were the Techs and Financials. These comprised 50% of the SPX point advancement. Last week, we highlighted the lagging tech, today we had the financials naturally pause sucking in the gains & slew of paper. Naturally, we pause and succumb to some profit taking as the tape goes with the recent leaders. No matter, Banks- Brokers still acted resilient considering all they have to deal with. If 50% of the SPX move is going on hiatus until a positive catalytic event, we are vulnerable to the beginning of a correction for the market.

Fortunately, here at DJIM we have focus on EPS stocks & selective sec's. Today while the market plays in the red, we have stocks DJIM linked stocks EBS, (reader forum eps note), BWY (buy at BAC/MER today) and the Gaming /Lodging sector plays ( WYNN LVS MGM..) still showing signs of squeezing as more LV and China notes come out over weekend. This is shown in the "Room for Green..", intraday post. Some may look to defensive sectors like HCare, biotech etc in event of a correction, we're fine with concentration on recent earnings which sometimes fall into those sectors anyway. EBS has always gone against the trend of the market as seen in a yrly chart. We've talked of eventually the market playing into our hands and the easy trade. Imagine if today's action in EBS LMIA BWY signals a possible return one day to micro- small caps as we get to an economic trough with attention swinging back to..dare we say it back to IBD type of stocks, where growth matters. Hey, why wouldn't hedgies exploit this area once again to pamper their books?

Besides FSYS comeback to our lists, we have added PEGA LMIA to our potential tradeable EPS list. Like last weeks EPS list, we watch to see if these make the grade, most from last week are flirting with 9ema.

As far as tech, we have upcoming analyst meetings, tier1 conferences to watch in the short term for direction.

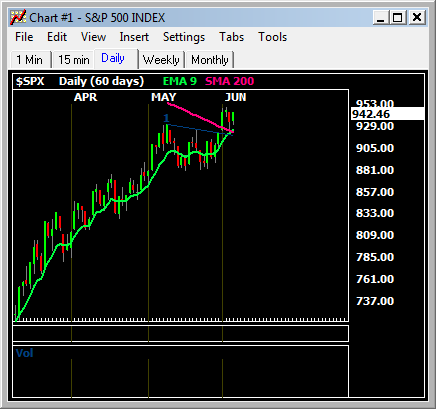

We held 909, at close, which represents a recent trendline, (898 a recent low-the psychological 900 )is where we want see the underlying bid prevail.