...and the number is...????

Friday, June 4, 2010 at 07:00AM

Friday, June 4, 2010 at 07:00AM Most of DJIM discussion this week centred around home front/Economic data. It‘s slowly making it‘s way back to the markets talking heads. This is good because we are finally taking a break from Eurozone and switching some focus. Well, we don't know how long this is going to last because once the NFP report comes out tomorrow, folks may just concentrate back onto the Euro worries now that the market has rallied from SPX1040 to 1105/200ma. Many have not grasped that we've actually rallied since the 25th/1040. Those in the rally play may want to sell over 1100, but those sidelined may begin to feel some anxiety of this move going further. Stay tuned...

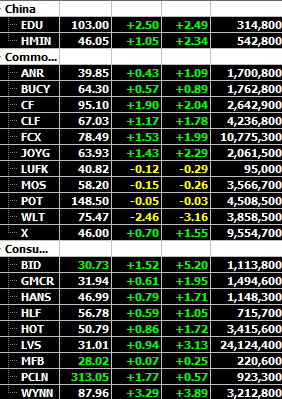

However, it's important to give some thoughts on the recent Econ. data. People have been pointing out the fact that although the Economy is recovering, growth has slowed recently. The fact China is down >20% is evidence of the ’growth’ investor has been slipping away this year. Also, fear of Euro May problems derailing activity in US has been on the mind. This weeks macro #`s show it hasn’t derailed things in May. The eco` downshift may not be as great as feared due to Eurozone. Unfortunately, a fresh twist in our waters now... the ramifications of the BP spill will begin to put June #'s into question sooner than later by the market.! We feel all these fears are very natural because sooner or later this is what had to happen for the markets not get out of hand. Basically we need to level off the growth curve for a bit before we can tick higher. The biggest obstacle to the recovery remains the unemployment rate. It seems no matter how many jobs we create, it just won't be enough to replace those millions of jobs that were lost during last couple of years. It'll be a long way before the unemployment rate comes down to a reasonable level. By then, the Economy will be at full steam and we bet many of the plays-sec`s we like will be trading at a much higher valuation. This is always the case in an upward Economic cycle.

As far as market goes, SPX stopped dead at 200 MA today. Volume was relatively light and people are most likely waiting for the NFP report tomorrow to give them a reason to make their next move. Today’s somewhat green to flat action gives the market some room to manoeuvre, if we broke out over 200ma today, we’d probably have a better chance for a sell on the news(NFP#), no matter what the # would be. As we all know, selling on any NFP# is always a possibility and will be on this census skewed report as well. Watch private sector jobs, whisper highs a tad over 200k.

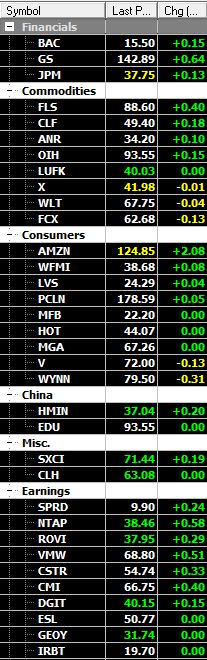

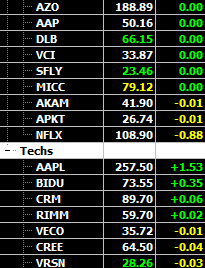

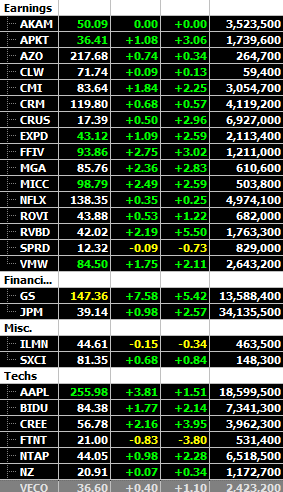

Excluding the commodity linked stocks (Again, China housing clamp cooling property mkt big time), many plays behaved really well, especially in softie tech. We had M&A activity (SNWL) once again in the group and DJIM listed softies, CRM VMW and another VRSN added hitting NCH`s. (will update Shadowlist this weekend). Others like DGIT, DLB also put in nice days.

In all honesty, if we can close out the week in a relative quiet fashion, it'd be a nice confidence boost for the sidelined investors to slowly buy into the market again. Right now, the most important issue for this market is to ease the volatility and stop the late day sell offs. It stopped today and yesterday, let this continue today and we`ll be happy heading into the weekend.