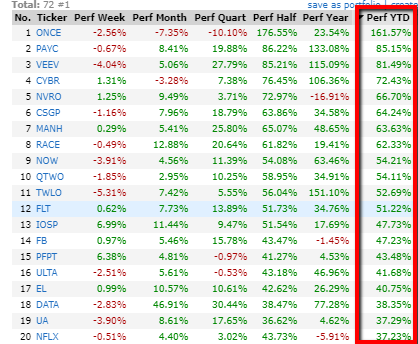

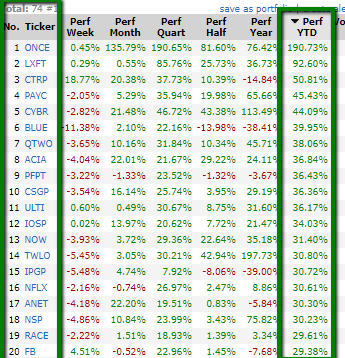

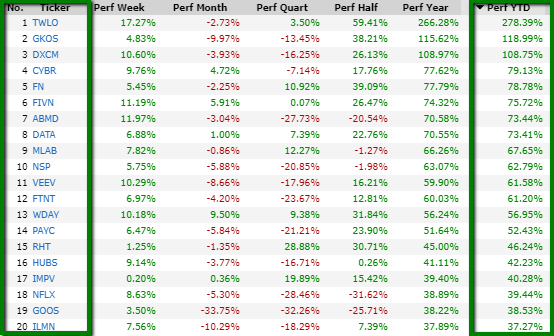

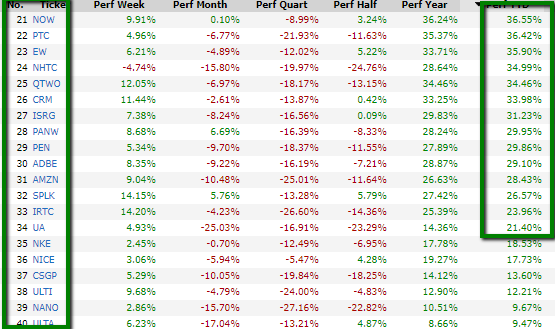

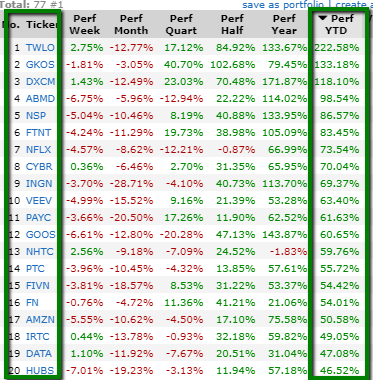

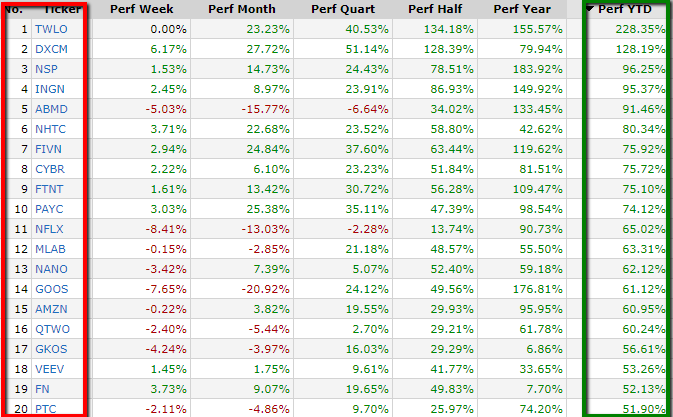

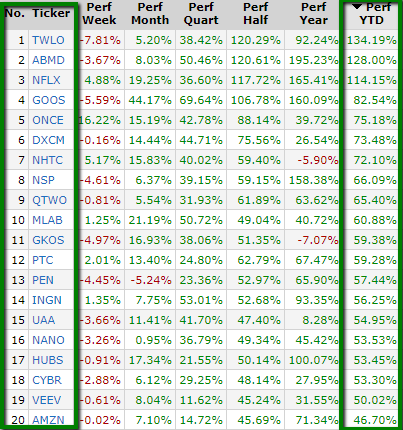

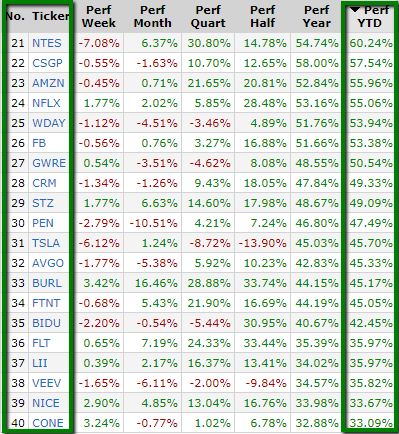

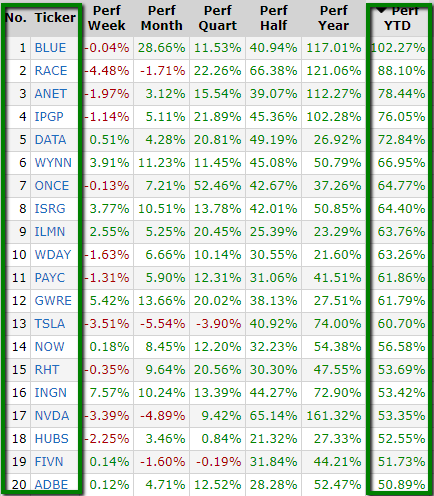

1st Half '19 FINAL ~40% up 30+%- YPT SHADOWLIST STOCKS INTO '19 - $ONCE $PAYC $VEEV $CYBR $CSGP $NOW $DATA $PFPT

Monday, July 1, 2019 at 03:23AM

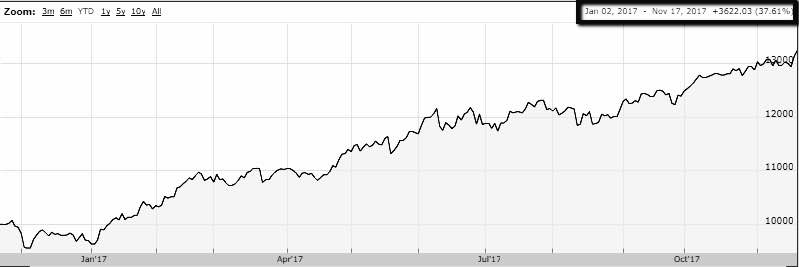

Monday, July 1, 2019 at 03:23AM YPT Shadowlist 'book' of approx. 80 stocks is tailored and fragmented (outperforming SECTORS, SMALL-MID CAPS, EARNINGS/ GROWTH (EPS) linked stocks, IBD 50, MOMENTUM STOCKS) to gauge single stock action and the broad underlying market for SP 500 direction to go long or short. New plays (stock/sector) are added- deducted, especially during earnings season.

97% of fund stocks are same entering 2019 as 2017, no turnover = no fees *churning*(to the investor).

Results- scroll below for 2018 and 2017 stock portfolio results and plays. Due Diligence, you cannot beat as an investor, so do some before investing in anything!. This site since 2006 is an open book.