Away from the spotlight...

Wednesday, May 20, 2009 at 06:33AM

Wednesday, May 20, 2009 at 06:33AM Basically, all of the action today after a triple play rally is not from the usual movers and shakers , instead it’s from our boring listed plays..old (commods’ ) and new (EPS’). The index may have closed flattish and financials rolled over naer close, but it's otherwise a pretty swell day around these parts. The biggest story of the day occurred AMC. We are referring to the gigantic offering from BAC. Here's the eye catching number, 1.25 BILLION shares at an average price of $10.77/shr were issued/ sold by BAC. Over 800 million shares look to have been sold in a large block!! Wow, this is just something we don't see that often in our lifetime. Will this massive offering give some more firmer support to the market? After all, traders were worried that BAC might have trouble raising money, but it's just not the case.( now ½ done to 33.9 capital plan). We have to view this as ultra positive It wasn't a big deal for GS, MS or WFC to raise money, but a massive secondary raise from BAC(somewhat inferior quality bank), a 10% discount to the daily avg since announced seems to have not been a big deal either. As much as you'd think this would suck up a lot of cash from the investors, this has to be viewed as very positive development for BAC, the financial industry and this market in general as someone took a huge 2/3 stake of the offering.

Now..the real action today was from a lot of our recent earning plays and the group plays. We’ve been highlighting buying pullbacks awhile now as our 'Premise' holds. Recall, we said many new plays are toying around 9ema, of course this would include most of our plays as we've been in a 5-6% corrective market. eg. BWY DDRX NEU GYMB FSLR ICE CTV LIFE...In addition to the earning plays, if that's not enough, we also have commods’ feeding off the weak $USD unwind, GNK JRCC SCHN X and agri.(POT, MOS ) since we *highlighted crop report last week were gaining more ground today.

Earlier, we also had EJ , a former gem here, which guided pretty nicely, gained a trade spot quickly on to our playlist. In fact, it seems many of the old Chinese plays are heating up here again. ASIA SNDA TSL.. are just some of the plays acting well. Remember, we have CAF to basket a further move here. SOLF also reported a not so bad quarter and gained some positive reaction today from firms. This may bode well for solars STP and TSL reports coming up. Also, NTES SINA SNDA are other China reports shortly.

Also side market note , CY (semi) had the most bullish comments from the often mentioned ‘tech conference’. Conclusions from conference are more positive than expected and we should see the space continue to get a bid this week. ADI (semi)had a good report AMC

On the other hand, we also have runaway earning plays like ADY STEC , which we are patiently waiting for a pullback before making a potential entry. As we have mentioned before, this market is full of good trading plays and we really appreciate a slow trading day like today.

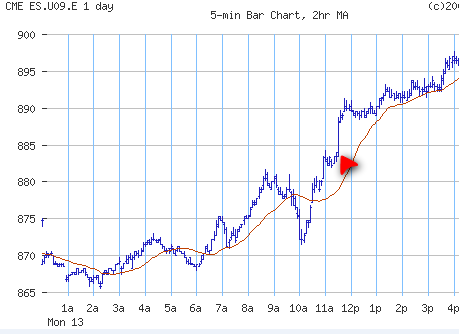

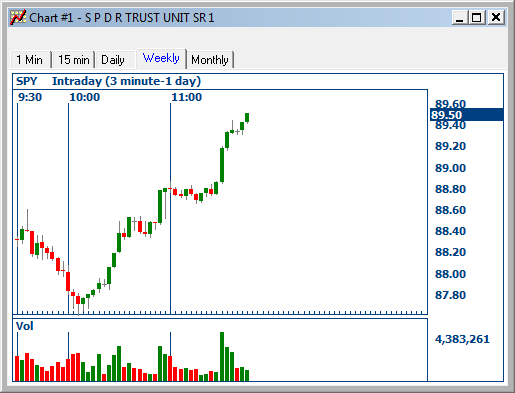

Technically, we are currently range bound (876-929) right now heading into a holiday week. There's no telling how the rest of the week will play out (FOMC minutes tomorrow), but we do like the action in many of the individual plays on our list going forward. If this market can nudge higher, our question and answer to “Sell in May or will it be Buy in May?…was correct at SPX 872 as it‘s become a stock picker‘s market , dominated by earning plays churning this market higher.

http://www.djimstocks.com/djim-journal-09/2009/5/1/sell-in-mayor-will-it-be-buy-in-may.html