Triple play rally!

Tuesday, May 19, 2009 at 06:25AM

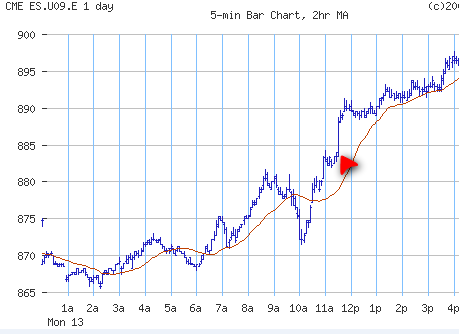

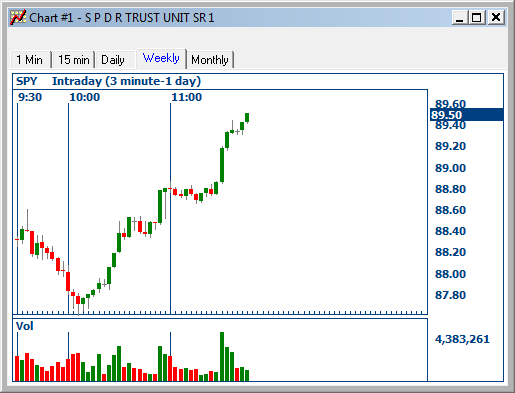

Tuesday, May 19, 2009 at 06:25AM What's a triple play rally and what are the ingredients to such? Well, in our view it's a combination of 3 players getting into the act!. We clearly had that today!

1- Recent week worth of trading was a week of lower highs, lower lows. This is a clear sign shorts were starting to press fresh new positions. Every time there was a blip upwards, the shorts would press positions lower and lower (thus lower highs) as they were becoming a little giddy after not having this opportunity for weeks. So what happens when this pattern of lower highs/ lows gets busted over ~896 today, including holding overnight support at May 4ht lows. Yep, you get them shorts scrambling to cover once again. Ingredient number one is short covering. (See alert comment around 2:45pm before the next rip up to know where we think we’re probably going now).

2- We’ve talked a lot about 5% SPX correction as a measuring stick, it also coincided with 20ma and a great place to find an underlying bid. Look back to the April's 5% dip that brought out buyers, eventually leading to 930 highs. Today, we got this sidelined money seeing this market doesn’t want to break 20ma and use the 5% as reason enough to get in.

3- The sidelined money (longer term $) + short covering equals momentum money coming out to play and only adding to the fury of buying. Last week as everyone was saying get into the "safety trade", we said we’d hang up the phone on our clients if we were brokers asked to switch to such a trade going forward. Clearly what we saw today was a rush to 'higher beta stock and groups' as money from the safety stocks- groups was a source of funds to switch in higher beta’s once again. No better sign of this was in Casino- lodging stocks. Last Fridays alert buy in to WMS was timely and others like HOT, WYNN, LVS and the more spec' MGM provided big gains across the board.

Of course in order to have a triple rally, you need a catalyst or 2 …to wake the sleeping giants from their 'quiet period' and we pointed out a few we were looking for. You probably did not see ours mentioned anywhere as a potential catalysts to reverse this market in the upcoming week.

1) One part for the banks- brokers was our underlined, determination to repay TARP. Only near the close did the headline finally come across that GS-JPM-MS have applied to repay 45 bln in TARP. STT applied earlier. If you think our mkt went up all day because of Indian mkts and not the fact this `determination = apply` was making the rounds all day with institutions types, you’re greatly mistaken. *Also importantly was Geit`s saying he doesn’t want to see executive comp. limits. This always makes Wall street happy. *We also think Barron’s negative article on Treasury’s was a lift to equities as this says go to riskier assets such as stocks!.

2)A wake call for Tech was the possibility of the what comes out of the upcoming tier 1 tech conference. This provided some positive eco` comments, such as NVDA`s, 'market bottomed..product demand growing and improving from last 2 Q`s'. Tomorrow, we`ll hear from companies like NOK, IBM, EBAY , we also have April Q reports coming from HPQ BRCD ADSK soon to add more clarity to trends after the official Jan thru March earnings season.

3) We even got a 3rd catalyst from earnings side of things. We pinpointed HD last week, but LOW`s gave enough in a positive beat and raise to guidance before HD`s report tomorrow.

Points 2 and 3 is something shorts are not really expecting as they keep saying earnings season is over with. They are missing the point these April Q end reports can do some serious damage to their thinking earnings season is done with. These give a glimpse to what is happening after March and if its good, it points to a better than expected Q2 reporting season.

We had a good NAHB number today, tomorrow we get what could be as crucial to markets mood as Retail was last week in the form of housing starts and building permits.