..some resiliency signs..

Wednesday, August 4, 2010 at 06:53AM

Wednesday, August 4, 2010 at 06:53AM The market got an early bid and was up nearly 1%…oh wait, that was the bond market from the QE noise!. The equity market was the one down nearly 1% before staging a decent reversal from the ~1118 levels and afterwards flat lining for the remainder of the day. This was the expectation to consolidate and the hope not get a retest of 1131, just yet. The view is it’s better the market didn’t even try to follow through from the previous days big gains and possibly succumb to selling if it tried to push 1131 too quickly. Maybe this way, the market can generate some mustard by spending time bouncing around a tight range to show levels like ~1118, even 200ma~1114 will provide the necessary support to uplift the market in the near term. In other words, give some confidence to those on the fence at this point.

A key takeaway(s) from today could be the resiliency in the market showing up. Despite a handful of negative reports from household names like DOW PG down 4-10% and not so hot macro data, the market held up quite nicely. Also, the terrible underperformance of the consumer discretionaries didn't spook the market. MA, didn't have the most pleasant things to say on spending.

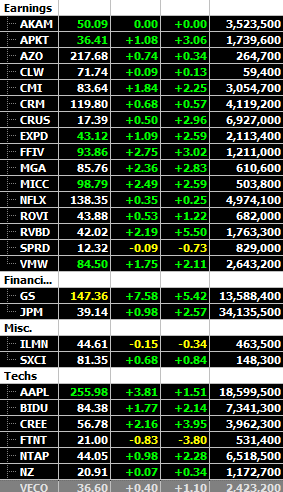

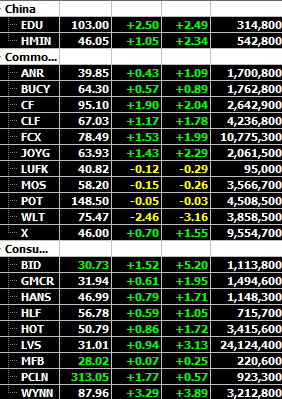

Away from the broad market picture, we had numerous previous small caps put out nice reports to trade into the Q, a few like CTSH ’s amazing sequential growth and PCLN had robust numbers. Even, STEC shows sign of a turnaround for the short term. Other notables include RBC OPLK HLF VSH to stick on the shadow list for the Q to go with the VMW EXPD ILMN CRUS CLW RVBD earnings plays from July. The more the merrier….

Demi/ YourPersonalTrader |

Demi/ YourPersonalTrader |  Print Article |

Print Article |  Email Article | tagged

Email Article | tagged  CTSH,

CTSH,  MA,

MA,  OPLK,

OPLK,  PCLN,

PCLN,  V,

V,  VMW EXPD ILMN CRUS CLW RVBD

VMW EXPD ILMN CRUS CLW RVBD