All about EPS to some...

Friday, April 24, 2009 at 06:00AM

Friday, April 24, 2009 at 06:00AM Other than the EPS stories (to DJIM), there was no dominating noise to explain the market stability and rise today. As a whole, this market shrugged off the morning weakness and closed the day near the high. This is quite remarkable given the weakness we had toward yesterday's late day session. Technically, we dipped south of SPX 840 intraday, but it’s only bearish if it closes there. Mkt closed SPX 850, right in the middle of the range we‘ve focused, sort of the battle ground these days. As we have mentioned the last couple of Journals, we seemed to be range bound until something catalyst that can drive us higher, or lower.

The market players are attempting to say such things as, (Briefingcom)…Another factor keeping a lid on rallies right now is that this earnings season is shaping up to be essentially a lot of white noise….Moreover, while the unexpectedly high number of current quarter beats might normally be seen as a positive catalyst for the market, what is keeping a damper on most earnings-fueled rallies is that: 1) stocks already have had extended runs into their reports, and 2) as is typical in a recession, these bottom-line beats are most often enabled by aggressive cost-cutting rather than stronger than expected demand.

Here at DJIM, we are not looking for another substantial rally, we just want to see the market break this range. Yesterday before the open (Forum), we noted their was ‘broad’ corporate trends that we felt might give the market a boost. Considering, the previous close was ugly, a day with no catalysts and some EPS stories (CC's) during the trading day , we somehow closed at SPX850. We think earning are playing a quiet backdoor role. Do you have a better explanation?. This premise has some credence following AMC reactions to MSFT, AMZN. Of course, barring any “stress test” negative cataylst, we think the market may abate the “ selling the news(eps)” and surprise many by breaking over 860!.

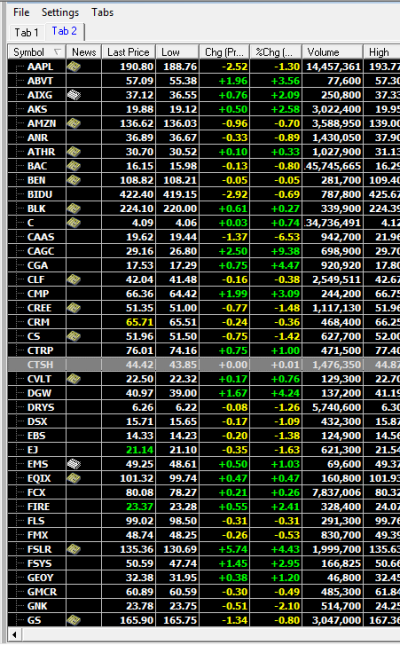

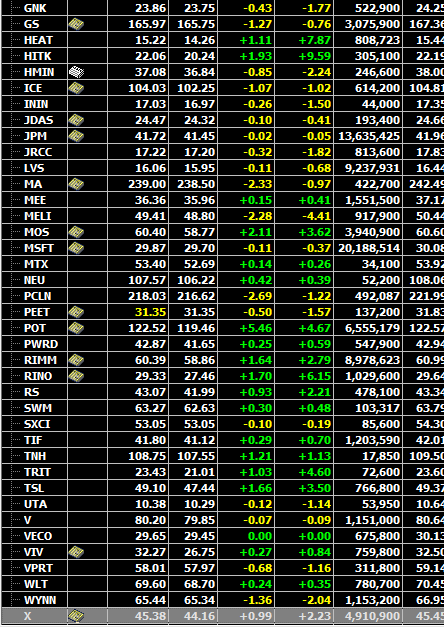

As far as individual/ stocks, we couldn’t be more pleased with the action LVS WYNN. Both continued the squeeze potential we alluded to and were up another 10% early while the overall market lagged. We also had a nice 3+ move from alerted PENN , a “Racino” off earnings, besides the earnings we liked it fit because it fits into the Gaming play.

On the negative side, we’re sorry to see our favorite commodity group since late March disappoint. NUE, RS, and STLD all moved lower as the concern of the health of this industry lingers. The ag-chem sec wasn’t so rosy either as POT, did not inspire much confidence either after its report. This basically gave us the confirmation that you'd never know how this market will respond to certain report/guidance. On the other hand, we had a couple of well received statements from the likes of AAPL EQIX. We were actually quite surprised to see EQIX have such a strong reaction which is very different to last quarter's reaction to a similar report.

Banks, again, were leaders late carrying the market tape into the green. We commented BLK might be gaving reason for optimism later. It broke out with another 4+ points add on late and WFC, JPM, GS, STT, (PNC, CS earnings noted)... just a few on our list that performed exceptionally well. If the market players can let out a breath, a sigh of relief on the stress tests, the XLF breaking $11 will cause a nice break to the upside. The Futures are pointing to a lower open (low 840's), but we think this will change by open. Euro markets may give signals to market direction early on.

Tomorrow, we'll get a glance of the criteria that's being used in the all important "stress test". This is definitely going to be interesting as investors would see for themselves how some of their favourite companies will fare in the test.

AMC, we've had some nice reactions to the corporate trends for Nasdaq tech- linked MSFT, AMZN, JNPR SYNA and even in a financial link, AXP (huge expense cuts). Unfortunately, we also had the news that Chrysler is nearing an announcement to file for Chap 11. This should be overshadowed and relate more to sub groups. The trend lately seems to be favouring the EPS stories in our eyes. So far, we had quite a few market leaders that showed decent eps reaction, in our view AAPL is not 'selling on news' typical as others seem to be calling it because a stock doesn't jump 10-20%. This is definitely a high contrast to what happened last quarter as most of the companies were taken down hard after their earning report. That was selling the news.

At DJIM, we have been doing some quick trading here and there last few days. However, we are still waiting patiently for this market to make a major move. The probability, at this point, still favours an up move as oppose to a down move as 840 seems pretty formidable this week.