DJIM #7 2010

Tuesday, February 16, 2010 at 08:00AM

Tuesday, February 16, 2010 at 08:00AM A whipsaw week finshed as it opened. The market continued it’s up and down routine right to the end as China ‘RRR’ so-called surprise headline hit Friday premarket sending the SPX to low 1060’s once again. As pointed out premarket, we didn’t see it as a surprise feeling any negative reaction would be exaggerated. The fear mongers were out early, but rationality set in as the day progressed and CNBC began to have guests on that believed the same thing we did and the market started to rally back on the heels of tech. We’ve been saying we need a meaningful close above 1071 and now we have back to back ones that should change the tone to a more technial positive one for the short term. Also, finally, we had some dip buying come back to the market. Some buying was probably generated by better than expected eco’ data (Jobless claims, Retail). Last week was pretty quiet on US eco’ data, despite the shortened week ahead, it will be busier and important as we get fresh looks at February data.

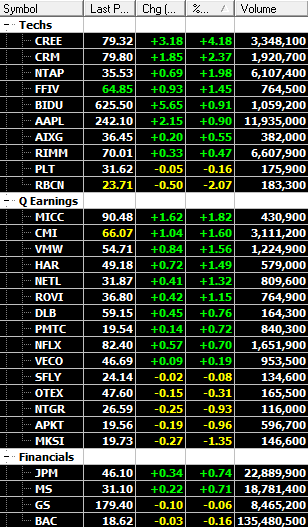

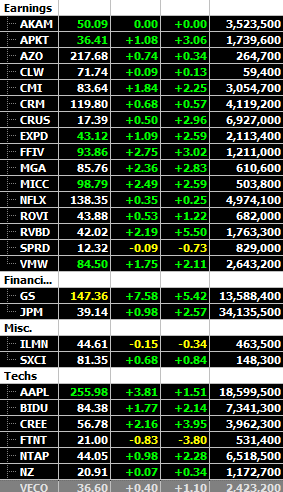

All eyes were on commodity linked stocks last week, but tech ($SOX) quietly came in the back door and duplicated it’s Thursday move on Friday as some money started to rotate into them from commods’. As pointed out, we think this is anticipation of some earnings reports in the upcoming week from some big names. Market might be anticipating more estimate revisions because of the reports coming up, giving potential for a bounce in the sector.

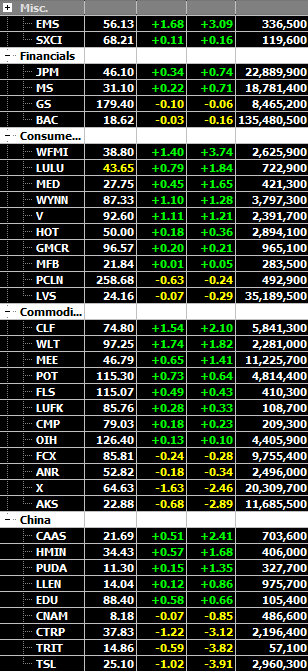

On the topic of earnings and tech many names from February released reports (mostly January Q end) are trading well. Names this Q include, VECO NETL DLB and cheaper names like SFLY APKT MKSI and stocks in other groups like HAR CMI EMS have also had good reactions.

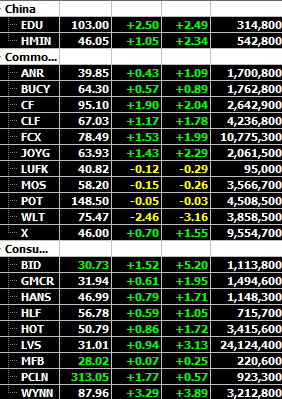

M&A activity in Ag’ space this weekend may provide a bid to these linked stocks.

Market is still on a fog on as it tries to look at something it can’t see clearly..Greece, China. These are market stresses, but, if the market concentrates some more on what’s happening here, hopefully with the help of some eco‘ data this week, it has a chance to stay away from recent lows. Importantly, there are some open spots in the fog to trade day to day, eg. commodity linked stocks or possibly some more tech ahead. Either way, recent earning plays are providing a pretty good place to trade.

Demi/ YourPersonalTrader |

Demi/ YourPersonalTrader |  Print Article |

Print Article |  Email Article | tagged

Email Article | tagged  APKT,

APKT,  CMI,

CMI,  EMS,

EMS,  FFIV,

FFIV,  MKSI,

MKSI,  NETL,

NETL,  SFLY,

SFLY,  VECO

VECO