"Home Alone"

Thursday, February 18, 2010 at 07:54AM

Thursday, February 18, 2010 at 07:54AM Isn’t it amazing what the US market can do when left home alone?. Simply..with China "Eye of the Tiger” on holidays this week not peeking over our shoulder and us not over theirs…and Greece acting as it should ..a “Club Med” vacation spot, the US market is running the house!

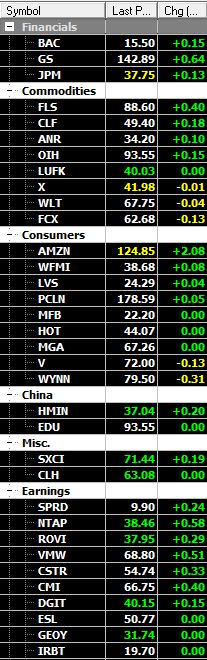

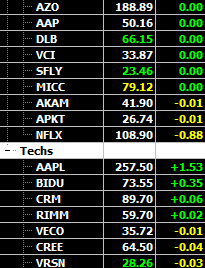

Today, the house was very quiet after partying for days as it should, a sluggish, choppy trade (although still firm breadth) that seems to take most of it’s cues from FX action. Earnings were led by our alerted WFMI, which helped the staples lead the SP500. Just on Tuesday, a strong Euro gave a bump to stocks, today an early sell off occurred as the Euro sank and USD strengthened, but in the end the market held up well. The signals sent from FX continue to be mixed, today even the strong USD didn’t hurt commodity linked stocks or the market end of day.

It would be advantageous to break 1100 soon, we failed on a few attempts today. If this failure continues it becomes a ‘psyche’ thing and nervous longs will start to think this rally is petering out and begin to take more profits. Also, if this level to 1005 is not broken through, it would signal a technical failure and odds would grow to the possibility of a 1040's retest. *Next week, the Chinese holidays conclude and Greece has some important dates, including a possible bond offering to have a negative effect on the markets. The Chinese RRR announcement came out after their markets close and their market needs to react and the reaction will likely be negative. So, as we said lighten those commodity positions and any China positions, especially before they begin to trade.

Conviction buying is needed and tomorrow the Joblesss claims will be eyed closely as longs need something extra at this point.

AMC, Tech earnings were inline and management comments are still inline positive, but nothing ground breaking. The trade was into these mid-week reports as noted last week, there is nothing new to propel tech higher, it should trade with the broad market tape.