June starts with a big bang...

Tuesday, June 2, 2009 at 05:51AM

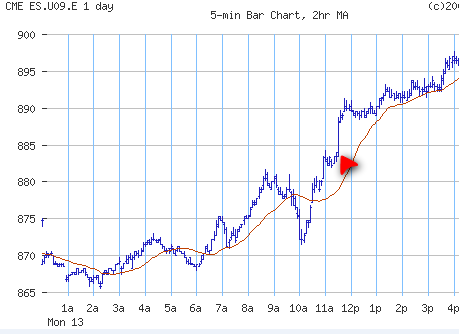

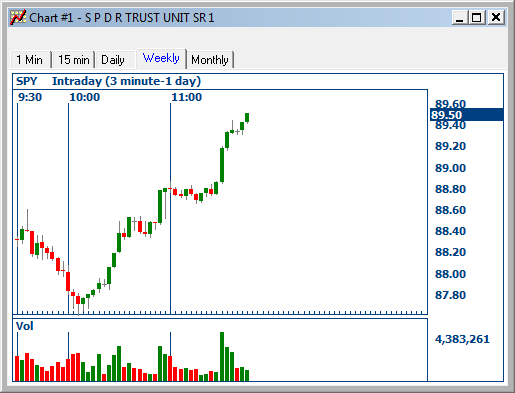

Tuesday, June 2, 2009 at 05:51AM This might not be the first day of summer officially, but, we officially kicked off the "slow" summer trading season with a very loud bang. The positive China PMI data led to strong overseas trading, the news of GM Chapter 11 (finally closure), and a couple of upgrades in the morning were enough to gap up the market on top of Friday’s strong close. We noted the importance of China PMI midday Friday and pointed out the impetus in Journal for a move from the month long trading range today… The “holding pattern“, we think is the market waiting for China to make the next move literally. It’s been pretty quiet lately after the initial ‘leg’ up and now we wait for signals for the global , eco’ outlook from China. This will (if positive) include help for the tech outlook and definitely the commodity picture for the 2nd half of the year". Today, it was the fuel for the impressive global market melt up, no doubt about it!!. The US ISM number (5th consecutive mthly increase) came out at 10 am and pretty much sealed the deal for the bulls. The "deal" we are referring to is the official breakout of the recent ‘May’ trading range.

Mid week around SPX 900, “…….we could be getting rotation into consumer driven NAS/tech coinciding with last weeks positive data points in tech conference/eps. So a close over 1430 $NDX can be very bullish and we could be on way to SPX 950, a clear break can be over 915, 920SPX, it may be useless and be a little late to enter after breakout levels we've been talking (930’s May highs)". What we are pointing here is the $SPX literally made a move under radar in 1-2 hrs of trading of 40-50 pts to a high of ~947 and you’ve missed it, if you were not positioned in low’s 900’s last week to take advantage of the stealth move. Considering, we literally hit that ‘on way to 950’, it's an excuse to take profits off table and re-position. We’d welcome a pullback to re-initiate many positions, whether it is tech, commods, china linked stocks.

The volume across the tape may not be as super strong as a breakout volume would've warranted, but we’re pretty sure many still can’t believe their eyes and continue to sit on cash. Money is sipping into the market slowly, but the world has literally missed the rally. The statistics don’t lie as many refuse to believe we are in anything but a mild recovery. The world is underweight, including hedgies, 'whales' and will eventually lead to more upward pressure on equities in the future.

As we have been pointing all along, a break to the upside has always been the more likely scenario. Someone has to give up and there was too much "upside risk" for the shorts/ Bears weighing in on this market. Technical this time. Recently, we've had way more positive eco' data points compared to the negative ones. The earnings have been better than expected and action in the emerging market lately is nothing short of superb. This is also coupled with the fact financial issues are somewhat behind us. Everything that has happened lately is viewed as positive development for this market over the long haul. Therefore, in our opinion, this breakout was inevitable and hopefully our bullish stance at DJIM has payed off for members lately and since March.

So, what's the trading strategy now? Although, we aren't in a mood to chase anything new today, we are mentally prepared to buy stuff back on any worthwhile pullback. Basically, the price level that you've seen a few times when SPX was at 875-880 level may not be there in the next little while. We have to be comfortable with the idea to 'move up' our own buy trading range. Earnings plays are still the same and those that showed exceptional technical strength are our favourites. Techs, Commods and China syndrome are back in full force these days. Besides the obvious long standing commodity/ tech stocks (most on shadowlist link), we had some recent add-ons such as lodging play HOT (last alerted low 20's) for a breakout top range move, EJ, china earning play breakout recent tops, CVLT, a tech play is near 2009 high, slow crawler BWY is back near $15 highs after a pickup here at ~$11.

Oh yeah, were you a good trader and monitor these potential earnings plays we put up early May in a secondary shadowlist? Some nice pullback buys emerged in what many called a terrible chop trade in May, but as we said it's a stock pickers market going forward and many were making fresh highs today...eg, SFLY, STAR, TNDM, CTV. Stocks on list like DDRX NEU PENN GMCR were already in play at DJIM and are likely on our shadowlist link. Patience is a virtue and pays off well if you have the right earnings stocks. It is also quite a safe trade and lurking a good pullback works well.

http://www.djimstocks.com/djim-journal-09/2009/5/6/new-eps-this-q.html

Oh yeah, did anyone catch the AH news that EMC is coming out a competing bid for DDUP? Remember, we picked up CVLT last week as a secondary play here. To be honest with you, we haven't seen this kind of action in the tech land in a long time.

Summer trading, fortunately is also slower paced and has lower than average trading volume. This is actually better for us to not have to worry about chasing some wild strength. We don't believe this market is capable of going straight up at this point, so there'd be plenty of opportunity to get in on this leg. However, when the setups do present themselves, you don't want to be shy away either. Bottom line, we are feeling very confident and comfortable with what may come the next couple of months. Summer trading, once again may become fun.