DJIM holds/ hit list#8

Saturday, October 7, 2006 at 04:50PM

Saturday, October 7, 2006 at 04:50PM Time is flying by with not many changes to the DJIM list from week to week as we run into earnings season..hopefully to ride a thoroughbred or three. We don't care where the finish line might be, we don't care if they only go 6 furlongs/a Quarter or a mile and a half for a few Q's. The point is to get your share of the 'purse'. Anyways...why should we tweak with what's working for us and from what we hear for many of our readers. What happened this past week was more than a break of some of the tops on the indexes, this move included an exodus from commodity related issues in a big way that was felt around the world markets. One area to stay clear..definitely. So...the uptrend continued in the markets early in the week but the DJIM's RUT type stocks were having a hard time getting out of bed and going to work...by the time hump day Wednesday passed, the work week really started to roll for these laggards and they pushed hard so we all could enjoy a good weekend. It is obvious from our Journal where the concentration sits with our DJIM stocks recently...TRT, SYX and flash in the pan ACOR..RIMM.

TRT needs its own paragraph. We threw out the PR bone of TRT increasing capacity in their Singapore plant by 20%. Did you go hhhhmm what should I do with this info??. We sure did and with the timing of the pullback to the 9ema it was perfect timing to buy more as noted You don't increase capacity by 20% unless you got work to do!!. The backlog keeps inching up..more to come?, maybe as the PR machine is announcing contracts now. Friday morning we got a taste of the 20% with the contract announced by TRT. When we introduced TRT in the $8's, one of the things we said was we don't care if the insiders sell this first leg as the float and interest would swallow it up and move on. If you did some DD you might have noticed the buying of TRT by an insider all year...this was the one we sort of feared as a seller..not the CEO,CFO..and a few others with titles. Guess what..the CEO etc sold some but guess who's been busy this week BUYing...A HA!...he's back! http://www.form4oracle.com/company?cik=0000732026&ticker=trt

Speaking of lining up the ducks...did you see the fat duck with 60k block at 13.25 show up and get swallowed up hole in a second near the close. You can't ask for anything better.

TRT archive: http://djmarkets.squarespace.com/journal/2006/9/23/the-follow-up-on-trt.html

SYX. http://djmarkets.squarespace.com/journal/2006/9/15/syx-1340.html ....keeps rolling along..what else can you say, slow and steady now. You knew it was a matter of time before it kicked that growth off the IBD#1 slot. Fittingly as it makes it to #1 it makes the DJIM 25% list/benchmark officially...the 9th stock to reach this goal, many have been for much more than 25% since DJIM was introduced late August.

The craziness spilled into ACOR, our "$2 dollar ticket" to possibly hit the trifecta has turned into a habit of going back to the track almost daily. Been there, done it..can you tell..lol. This week was the 3rd charm as we bot the low 11's and watched it turn into a wild horse with all of you. We have discussed this type of play in detail and will continue to look for opportunities to re-enter. As we said in MC before this ride to the high $16's...this ain't through just yet. We still feel this way as stomping the shorts probably is not done with. Watch for PPlacemet to be announced as completed for the next possible play opportunity.

RIMM..the black sheep of the DJIM family in size has acted nothing like it as it's put in some nice points to the upside as well. Since our AH buy and profile it has come back to our price before catching the winds and climbing 12% for us by friday, hitting $112+ before giving some up to the profit takers heading into the weekend. Maybe it was just Lemieux and the Penguins hacking away as RIMM climbed and climbed.

IAAC...doesn't it just feel like it will catch the volume and explode up?. Since we've been following from the 12's it has always received volume out of the blue. As it creeps higher, it feels inevitable....number 10 on IBD might just produce such interest again...a refueling of sorts.

That's the cream of the DJIM crop last week with most of our efforts and therefore dollars concentrated on. When things roll it is easy to lose sight of others...the DGIT's of the world. The CPY, CETV, EDU, MR have made nice returns, some just for quick trades and sit quietly in a range as we wait for a move to gain interest again. These are not losing anyone money, the story is still there and we hope to play these more again. EML..a crawler we mentioned before the pullback we actually wanted..is near the 9ema and next week has its record date on the 10th for the 3 for 2 spilt. AZZ'zzzz is snoozing with volume drying up last week, the chart looks like it drew a flagy thingy for the past 6 sessions and its about time it picked a direction. Considering the earnings... still betting to the upside. Also an eye on past DJIM listed stocks..ANGN, TWLL as they knock on high's doors.

As EPS season starts keep tuned to the "Extended Trading" thread in Market chat before and after regular market hours. Many of us like to play and enter positions early or use the extended hours for a fast trade. We look for your input in catching something good.

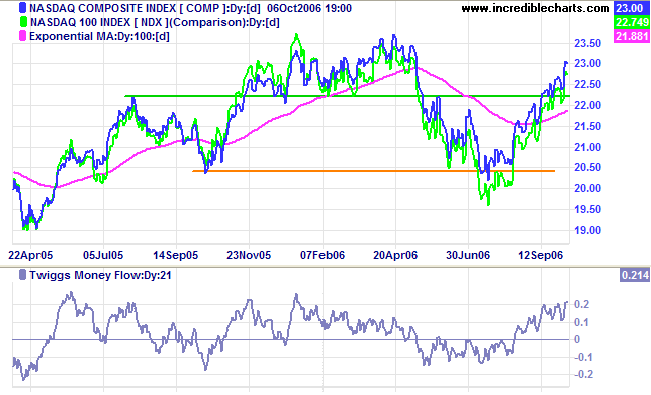

COMP/NASD100

COMP/NASD100