Not to get too complacent..

Wednesday, March 10, 2010 at 07:05AM

Wednesday, March 10, 2010 at 07:05AM Early on today, the market felt like nothing can go wrong and we can slow grind to SPX 1500 in about 9 months. Well, as sarcastic as it sounds, I'm sure some of us have felt that way even just for a second or two, lately. Truth is, we'll have lots of bumps and obstacles along the way to whatever the eventual top this market will reach.

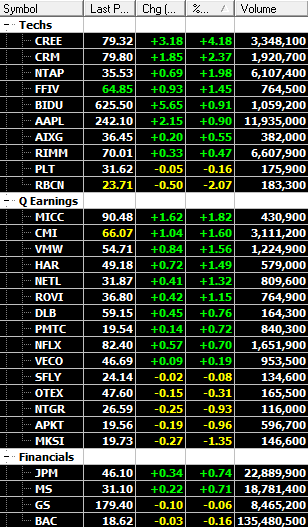

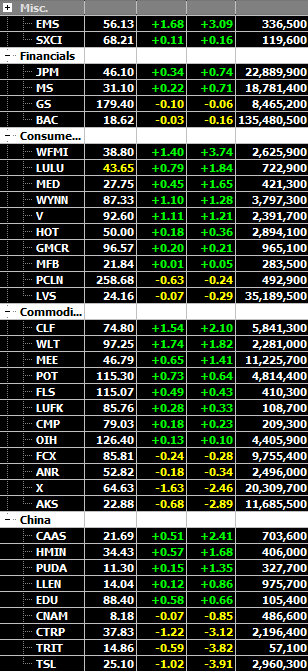

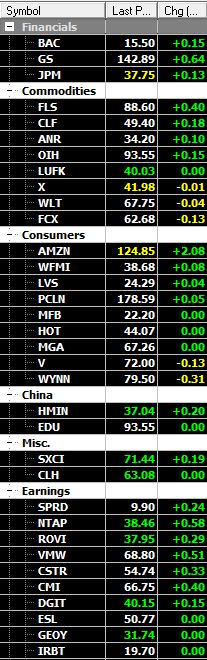

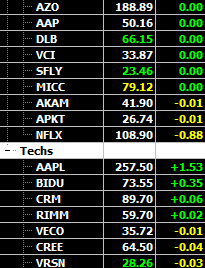

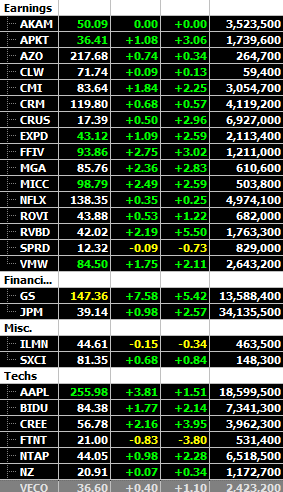

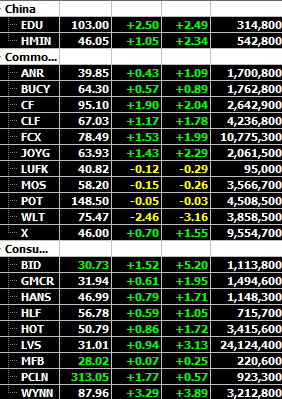

Although the market ended in green, many plays actually ended in red as fatigue set in and money flowed out of stocks. As always the bigger changes in price movement are more evident in high beta names (Casinos/China's). Still, recent alerts here of earnings plays keep grinding higher PLT, ROVI, MFB. Such is the nature of this market, one minute we can be all relaxing under the sun and next thing you know a storm comes which ruins the day. No real late catalyst today, so maybe just a drizzle as the market finished off the highs and has yet to join NASD/ R2K in making new highs. If there is any concern, it is this failure to join the party on part of the SPX and maybe why some money came off the table. Still, so far it’s only one day late, BKX hanging at multi month highs is probably a big signal as to what's next.

In all honesty, as long as we bring our "umbrella", we should be prepared for any storm that comes our way. What does it mean then? It means that we can expect for this market to pullback as soon as people start to get complacent. In a way, this is healthy behaviour. Some of us would love to get back into some plays at a much attractive price. We believe we'll get our chance, sooner than later. This is the kind of market that does not go up in a straight fashion. It may have a mini stretch of a bull run, but it will always stop at some point. The ground this market gained will be tested and we have important level at SPX 1150 to retest.

Over the next couple of days, we have some important Econ. data coming from China. Those data points can very well be the tipping point we need to move this market higher or not. In the meantime, we aren't expecting much news from our home front this week as noted earlier this week. Bottom line, we are begging for some more sideway action before we can give 1150 a real attempt.