....take off?

Friday, January 16, 2009 at 08:08AM

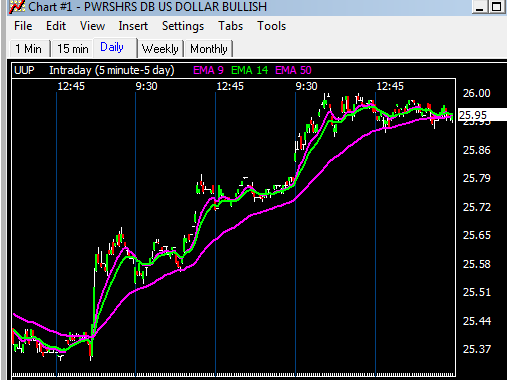

Friday, January 16, 2009 at 08:08AM Not everything had a bad take-off in NYC today, maybe if flight 1589 had used runway SPX 820 like Wall Street, the miraculous event may not have happened at all. To be completely honest and to put the rally into context, we were glued to the unfolding events in the Hudson, not the last 30 minutes of trading on the market!. As we noted in Journal and early post, the level the watch for action around 820 unfolded later as the oversold market bounced hard off support at SPX (cash) 816-818. Preparation is always key to trading. If the market breaks a support level, you say 'oh well (chit)', otherwise you have to be watching closely & continuosly as a trader to see if something materializes as it did today to profit. Simply, everything that had to be done trading was done by 3:30, which included selling any intraday and/or old positions as this was nothing more than a short covering rally off way oversold levels. This doesn’t mean this melt -up can’t continue tomorrow, it just means it has done little so far to make one think it can last more than a few days. Once SPX 50ema turned up Monday, it was a very bearish sign to break that level as it finally had just 'turned up' in contrast to breaking support off a downward MA. There will be lots of talk what turned the market today, included is the dismissed idea of nationalizing Citigroup, but it really doesn’t matter what noise helped, other than realize it was ‘technical’ on all levels!. We also had, (yesterdays Journal)…’Intraday swings are more likely to return in this environment…up and down”. Well, the swings are back as witnessed and that just pounds in the fact we won’t be able to sustain a long term move upwards. This is probably the time again to just watch the sectors/ stocks off our shadowlist and trade whatever is moving that day until (if) we get something to trade off earning reports or just trade the DJIA/SPX ETF’s off major support and resistance levels.

They're back!!...There is an ominous side to the current trading environment and that is hedge fund redemptions have not gone away!. The headline read, “ Investors pulled close to a net $150bn from hedge funds last month in spite of moves by dozens of funds to halt or suspend redemptions; “We expected December hedge fund redemptions to be significant, but the results are still surprising ... twice the peak equity mutual fund outflows in September at $72bn,” . This will continue to be an overhang into the market and you have to think any sustained rally will be shot down on more redemptions sooner than later. As we said day 1 of what has turned into a daily saga, ‘Bernie the Ripper’ will cause investor confidence to shatter and it’s only natural money is now being pulled out of Hedgies hands.

On the bright side, the recent overhang of the Washington stories... Stimulus, TARP etc got a boost yesterday. The apple of our eyes was APOL squeezing the juice out of Citron and its' report, we spoke in detail of the fact, we thought APOL was too big of a fish for Citron to hook and sink. The stock was already performing well today ahead of the released stimulus plan and despite another Citron report on it, it rocketed as the education part of plan was digested. The bill was positive for-profit education services companies, with the group’s average rising 8%. You can attribute the strength to investors’ excitement about the additional pricing power for companies if the bill is passed as is. The stocks that outperformed the most are the ones with the highest exposure to private loans, which are not federally backed and remain largely unavailable, such as ESI (shadow list it) and add to APOL, STRA in this group. Still, additional steps need to take place before it even gets approved, but the markets exuberance cannot be contained if there is almost nothing else to trade sector wise. We'll see. Market doesn’t always trade on finalized facts, just like it took all infrastructure stocks up recently without knowing which company will be the big winner or when the money will show up on the bottom line.

Have a good long weekend!.