January rally on high beta/eco' cyclical sectors/stocks

Thursday, January 19, 2012 at 01:45PM

Thursday, January 19, 2012 at 01:45PM The market will make a smooth transition into the first week of ’12 with a slew of events, notably global PMI’s..”. Since eco’ data is the one bright spot, we put a lot of hope in it for 2012.” (END OF 2011)

__________________________________________________________________________________

Daily Journal excerpts: "Trailers of '11" rally recognized early:

Before Market open, Jan. 3: “Nice start to the year (following Global PMI’s) with a lot of sidelined money, new funds needing to get in the market early ’12”.

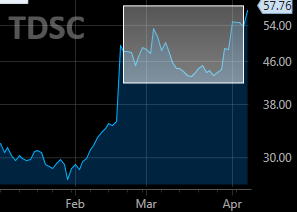

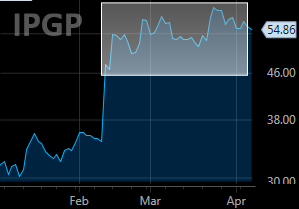

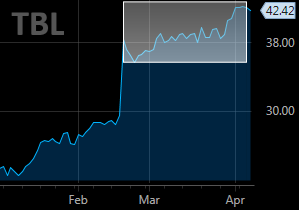

BMO, Jan 4: “This week will continue to be dominated by economic data and may bring late October highs ~1285 into play”.. Some of the reasons to like the tape action is the breath. The number of new highs was positive as was the bid for higher beta sectors (materials/commodities/financials. The largest trailers of ’11 (SP 500 stocks) were the ones getting the best bid.

“In all, quite a bullish day for the short term.”

BMO, Jan 5 : “Market is about the QE (LTRO etc.) going on in Europe, not these daily ‘peripheral’ stories. We need to remain cognizant of the Eurozone headlines, but it shouldn’t be the deal breaker in making a trading decision, right now”… “positive bias- sentiment here.”

BMO, Jan 6: “While the EU Bank indexes sink across the pond this week, the US financials/banks lead the morning equity bounces is the 3rd consecutive day of financials making the Daily Journal (some sort of record), which began as a note of buying in 2011 largest trailers ie. BAC, C”…

BMO, Jan 9: As per Journal pages all week, upbeat U.S eco’ data on the housing/ job front and surprising Global PMI’s overshadowed a quiet week in Europe. Traders (mostly) putting money on economic/cyclical related sectors,(led by housing/financial) and away from a highly correlated market trade..”

BMO, Jan 10; “The most important aspect today was China (Shang ‘index) getting on track off ... index was a wary noted yesterday. If this is the beginning of a reversal in the China market, it’s a very good sign for U.S markets to go higher as risky assets would rise out of better China sentiment.”…”In all, the positive momentum continues and can only get a boost from Asia….”…The same trends continue..” Traders (mostly) putting money on economic/cyclical related sectors”…

BMO, Jan 12: SP at 1293: “Most are underweight equities as noted previously; catch up mentality may propel market to low 1300’1315 SP”

___________________________________________________________________________________

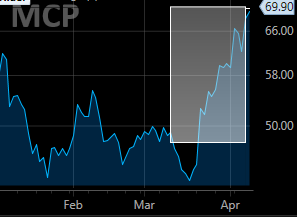

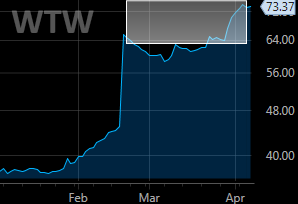

Jan 19, SP hits 1315 target, up ~4-5% YTD with all the early economic/ cyclicals sectors/ higher beta trade noted since start of month outperforming SP 2:1.