nice kick off

Tuesday, January 5, 2010 at 06:31AM

Tuesday, January 5, 2010 at 06:31AM Beating the "bull drum" since March… we don’t expect anything as dramatic as ‘09 (shockwaves of 08-09 are gone!) in both directions. Still, we expect a continuation of the rally into ‘10 as we‘ve been drumming in December to stay long. We are seemingly on positive footing which is advantageous to our ‘growth’ oriented stock/ sector picking as fiscal initiatives (unwinding of policy stimulus) globally will be baby steps. So, overweight equities is the strategy, we hope this becomes universal (retail investors) as returns on capital will be in the equity markets and fund flows will occur. High beta, small-mid caps, high beta regions, cyclical.

This was the theme in December, R2K went from 590 to a breakout to 640/>2% today on the R2K...Into Dec 3rd trade..."Even though the rally seems to keep losing momo’ in this range up to 1120 , we’re not listening!. Yesterday, we said it will be a selective stock/ sub groups pickers market going into year end and we’ll stick to that! R2K big outperformance up >1% of the market maybe a clue of things to come".

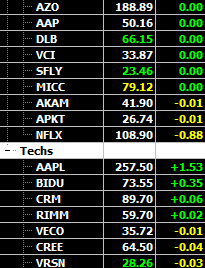

We left off before holidays with DJIM #51 and some selective names..."Only 2 ½ trading days ahead this week, some window dressing Q end may begin with some recent beat up mega stocks AAPL AMZN getting a bid . We think it’s a stock pickers market now and will be in 2010 as lower volatility and the search away from zero returns brings money into risk assets (equities).... Also trading some (GMCR OVTI ) off recent low possible turns)". One glance at charts off these stocks for the R2K period above and you can easily see the great outperformance to the SPX while it flirted with a breakout, yet finished the year below 1120.

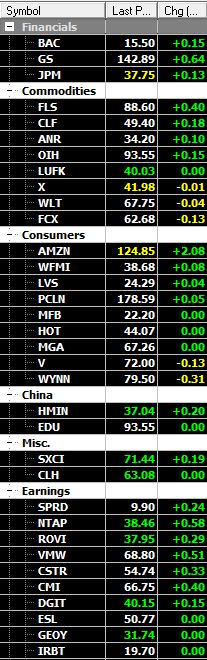

Today, we had the only underperforming group in December of high betas taking center stage with the Casino's led by WYNN, LVS +10%. We`ve discussed previously how fast these move due to squeezes and today was no exception after consolidating most of December. An upgrade and good Macau December numbers attributed to the pop.

Coals, WLT, ANR another high beta group also participated due to China weather again as supplies are disrupted.

Chems' Ferts, back near top of trading list after bullish GS call. More firms will likely follow. POT, MOS, CMP

This the bullish road we’re taking in early '10, a swerve would only be from tightening too soon, an error of policy here or abroad will cause us to change our stance likely. Heading into this earnings season, 3 strong Q’s have already been seen in the recovery and a 4th should be ahead. But, before earnings kick off, we have Global PMI December readings to chew on and U.S unemployment # to signal more broad recovery strength. Today's PMI globally/ ISM in US were solid, if not robust!.

Demi/ YourPersonalTrader |

Demi/ YourPersonalTrader |  Print Article |

Print Article |  Email Article | tagged

Email Article | tagged  AAPL,

AAPL,  AMZN,

AMZN,  Ag/Chem,

Ag/Chem,  Coals,

Coals,  High beta,

High beta,  LVS,

LVS,  POT,

POT,  WLT,

WLT,  WYNN,

WYNN,  cyclical.,

cyclical.,  high beta regions,

high beta regions,  small-mid caps

small-mid caps