'INTO THE TRADING DAY', PREMIUM DAILY JOURNAL, FOUNDED 2006

LONDON UK/ TORONTO CAN

PREMIUM ACCESS INCLUDES:

- INTO THE TRADING DAY 'MORNING CALL' JOURNAL - 5X/WK

- INTRADAY MARKET/ STOCKS/ SECTOR UPDATES/ALERTS

- ONE on ONE as required..

Daily stock market color and insight before every U.S market-open, 2006-2016 *(Into the trading day, 5X a week before 8:30 am/est.)*

* * NOW ONLY weekend edition tailored to investors/traders accounts as needed. Clients have 24hr access for 1-1 following YPT methodolgy/Shadowlist.

Follow our extensive trading desk experience and lead in recognizing daily event upside/ downside risks ahead of each trading day.

YPT bridges the gap between the retail-investor / trader and the institutional players by filtering out the noise, abundance of information (good or bad) generated through the media/ Internet.

Our daily Journals encompass YPT trading methodology allowing you to interconnect with us by 'Shadowing' our trading platform watchlist.

A 'Shadowlist of ~50 stocks is tailored and fragmented (outperforming SECTORS, SMALL-MID CAPS, EARNINGS/ GROWTH (EPS) linked stocks, IBD 50, MOMENTUM STOCKS) to gauge single stock action and the broad underlying market for SP 500 direction to go long or short. New plays (stock/sector) are added, especially during earnings season through Journal updates.

· A simple to follow package allowing any investor class to save time and enhance returns!. (Email distribution)

_____________________________________________________________________________________________________________________

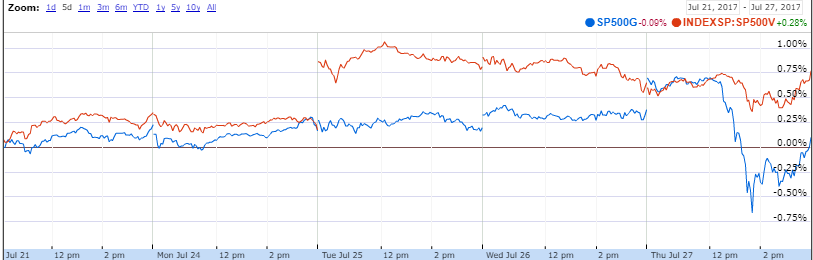

Growth monkey-hammered but algos did not run wild into Value as 2 previous sell offs since June.

Friday, July 28, 2017 at 05:34AM

Friday, July 28, 2017 at 05:34AM VALUE vs. GROWTH

Anticipated rotation into 2017 w/ 'Momentum' index $QNET ( $FB $AMZN $NFLX $GOOGL) Medtech $IHI (ANTI-Reflation trade)

Sunday, July 23, 2017 at 06:33AM

Sunday, July 23, 2017 at 06:33AM QNET +34.11% YTD

IHI +26.5% YTD

JULY 22 - OUTPERFORMANCE of QNET IHI and YPT SHADOWLIST

vs. NASDAQ - SPX - DOW

VS.

+27.5% - YPT BASKET OF 80 STOCKS GIVEN INTO 2017

1st YPT SList made public -JAN 17 (25%> +10%, 50%>+5%) and NOW (~45% OF YPT 80 > +30%) $QNET $QQQ $IHI <--#LOADED

Sunday, July 23, 2017 at 05:54AM

Sunday, July 23, 2017 at 05:54AM YPT Shadowlist of 80 stocks is tailored and fragmented (outperforming SECTORS, SMALL-MID CAPS, EARNINGS/ GROWTH (EPS) linked stocks, IBD 50, MOMENTUM STOCKS) to gauge single stock action and the broad underlying market for SP 500 direction to go long or short. New plays (stock/sector) are added, especially during earnings season.

JANUARY 17th

JULY 22

Since YPT market gauge hit NCH (New Closing High), market follows 'once' again to highs

Thursday, July 20, 2017 at 04:18AM

Thursday, July 20, 2017 at 04:18AM NDX 2.3% /137 pts

SPX 1.2%/ 30 pts

NASDAQ COMPQ 2%/ 123 pts

Here's is the entire move anticipated this month

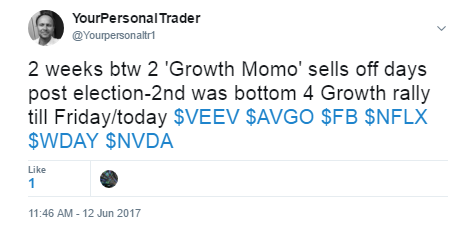

ANTICIPATED PATTERN OFF JUNE 9TH 'GROWTH/MOMO NEWGEN TECH' SELL OFF TO REPEAT POST ELECTION SELL OFF

Anticipated pattern off June 9th 'Growth/momo NewGen Tech' sell off to repeat post election sell off

Thursday, July 13, 2017 at 03:37AM

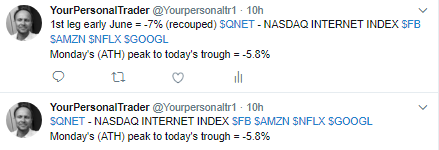

Thursday, July 13, 2017 at 03:37AM QNET - Nasdaq Internet Index ( YPT momo gauge)

JUNE 12- Last momentum/ Growth rout post election and start of our '17 'growth call'

JUNE 28- 2nd leg of 'Growth Momo" rout right on schedule - $QNET

JULY 8- No change last 5 sessions to premise laid out post early June tech sell off

YPT Shadowlist of 80 stocks is tailored and fragmented (outperforming SECTORS, SMALL-MID CAPS, EARNINGS/ GROWTH (EPS) linked stocks, IBD 50, MOMENTUM STOCKS) to gauge single stock action and the broad underlying market for SP 500 direction to go long or short. New plays (stock/sector) are added, especially during earnings season.

So much for Value rotation post June 9th sell off- MTUM,SPYG (MACD's boxed)

Thursday, July 13, 2017 at 03:07AM

Thursday, July 13, 2017 at 03:07AM QNET Nasdaq Interent Index (New Closing High) yestersday

SP500 GROWTH-

MTUM Momentum

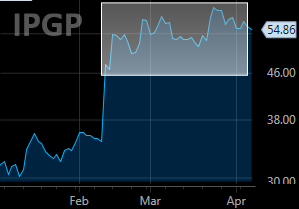

IPGP hits $150 - New Gen' tech/ earnings discovery @ $25

Saturday, July 8, 2017 at 06:48AM

Saturday, July 8, 2017 at 06:48AM

IPGP another NCH

IPGP _ YPT discovery at $25, a Shadowlist component since 2007

IPGP- January 9, 2007 at 01:29PM $25, recent ipo, accumulating some for sunnier days . Lasers, triple play broadband angle following OPTM today idea...even if is not the majority of business" ..........FORUM section..."IPGP has held ground at IPO day prices and this 'triple play' broadband hype is creeping into some names. IPGP might get some of that attention. rather accumulate some before"..before a breakout!. STOCK breakout and runs over 10% from 24.90's to 27.96 the next day. A 3 pt move in a day and half.

IPG Photonics Corporation IPGP

Daily Journal: "...IPGP was a little crazy much. Excellent earnings are being rewarded, it’s as simple as that.", February 11, 2011 at 07:46AM. In @45

And when started Twitter @ $61

---and at ~$70

YPT Shadowlist of 80 stocks is tailored and fragmented (outperforming SECTORS, SMALL-MID CAPS, EARNINGS/ GROWTH (EPS) linked stocks, IBD 50, MOMENTUM STOCKS) to gauge single stock action and the broad underlying market for SP 500 direction to go long or short. New plays (stock/sector) are added, especially during earnings season.

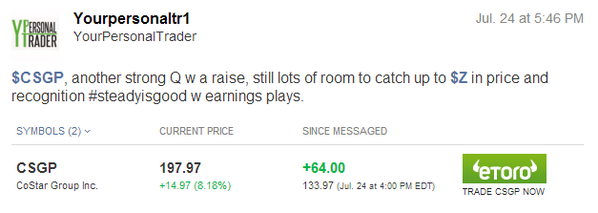

CSGP NCH @ $270 another YPT winner 2X PP- Shadowlist since mid '13 -$130's

Saturday, July 8, 2017 at 06:43AM

Saturday, July 8, 2017 at 06:43AM GWRE - NCH's off YPT Shadowlist basket of 80 stocks

Saturday, July 8, 2017 at 06:29AM

Saturday, July 8, 2017 at 06:29AM GWRE noted into the week- $GWRE- Growth stock suspiciously strong week w 3x Vol y'day

YPT Shadowlist add in $20's 2012

No change last 5 sessions to premise laid out post early June tech sell off

Saturday, July 8, 2017 at 06:12AM

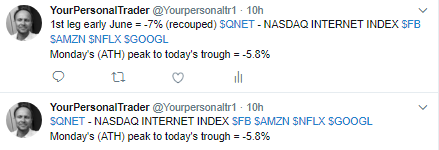

Saturday, July 8, 2017 at 06:12AM QNET - NASDAQ INTERNET INDEX

Reason the pattern is on the table is the peak to troughs in the QNET (home of FANGS).

Leg 2 is no worse vs. Leg 1, yet -5.8% is nasty enough with earnings around the bend.

1H - ~35+% OF YPT SHADOWLIST 80 STOCKS INTO '17 UP +35% - INC. $TSLA $BLUE $RHT $WYNN $ANET $GWRE $ISRG $WDAY $NTES $NVDA

Saturday, July 1, 2017 at 11:13AM

Saturday, July 1, 2017 at 11:13AM 1H'17 final

35% of stocks > +35% YTD gains

62% of stocks gains of > +20% YTD

6 of 80 closed red

YPT Shadowlist of 80 stocks is tailored and fragmented (outperforming SECTORS, SMALL-MID CAPS, EARNINGS/ GROWTH (EPS) linked stocks, IBD 50, MOMENTUM STOCKS) to gauge single stock action and the broad underlying market for SP 500 direction to go long or short. New plays (stock/sector) are added, especially during earnings season.

+23.3% - YPT BASKET OF 80 STOCKS INTO 2017 - $NVDA $AVGO $TSLA $AMZN $WDAY $FB $VEEV

Saturday, July 1, 2017 at 11:02AM

Saturday, July 1, 2017 at 11:02AM 1st half result of YPT BASKET OF 80 STOCKS INTO 2017, (no stock additions or subtractions)

YPT Shadowlist of 80 stocks is tailored and fragmented (outperforming SECTORS, SMALL-MID CAPS, EARNINGS/ GROWTH (EPS) linked stocks, IBD 50, MOMENTUM STOCKS) to gauge single stock action and the broad underlying market for SP 500 direction to go long or short. New plays (stock/sector) are added, especially during earnings season.

$GWRE- Growth stock suspiciously strong week w 3x Vol y'day

Friday, June 30, 2017 at 06:08AM

Friday, June 30, 2017 at 06:08AM Volume bar last week was rebalancing, yesterday?

Right back at you! - QNET -1.84% (-2.5% @ lows)

Friday, June 30, 2017 at 04:35AM

Friday, June 30, 2017 at 04:35AM Pattern repeating Nov/Dec sell off covered since June 9 is still on the table despite Thursdays selling.

Thought a rotation out of growth may occur on the heels of Bank news after close(Wednesday)

Premarket

"They can co-exist $IVX and $IGX Value /Growth- if thinking rotate on banks headlines - $BKX $QNET $QQQ $XLF

Unfortunately $ went out of growth, but did not rotate into Value and this snowballed into a broad sell off once realized. ($IVX -1.26% and $IVX Value -.36%)

"There's that Naz -50 thinking"

"Naz -100, Mkt forgot to rotate into Value off Banks news after initiating rotation out of growth $IVX $IGX $BKX $QNET $QQQ $XLF"

-50 ---- -100------- became -150 Nasdaqs

Reason the pattern is on the table is the peak to troughs in the QNET (home of FANGS).

Leg 2 is no worse vs. Leg 1, yet -5.8% is nasty enough with earnings around the bend.

2nd leg of 'Growth Momo" rout right on schedule - $QNET $NDX

Wednesday, June 28, 2017 at 01:20AM

Wednesday, June 28, 2017 at 01:20AM A repeater so far with rebound and 2nd sell off anticpated post 1st leg selling (bottom chart-12th of June)

QNET - YPT Momo gauge

JUNE 12th

___________________________________________________________________________________________________________________________________

LAST MOMENTUM/ GROWTH ROUT POST ELECTION AND START OF OUR '17 'GROWTH CALL'

Exerpt

INTO THE TRADING WEEK, 5.12.16

The unwinds and rotational trends continued last week, notably as growth took a 2nd leg down...

A 2 week rebound unfolded after 1st sell off. Most growth stocks including FANGS took a beating and were off 5-15% on the week as value outperformed growth. The NAS100 was off 2.65%...

The SP500 value to growth ratio has retraced 50% of the Value underperformance for the past 3 years and should stall out here and growth to stabilize.

Nasdaq 100 should help out by stabilizing at 4600-4700, SOX at a channel ~823. This should also coincide with consolidation in Financials/ Industrials in the near term and money to be used back in growth to close off the year.

The LT bull trend in growth is not going away due to a month of breath-taking rotation all over the marketplace.”

NDX CHART

YPT Shadowlist of 80 stocks is tailored and fragmented (outperforming SECTORS, SMALL-MID CAPS, EARNINGS/ GROWTH (EPS) linked stocks, IBD 50, MOMENTUM STOCKS) to gauge single stock action and the broad underlying market for SP 500 direction to go long or short. New plays (stock/sector) are added, especially during earnings season.

$PEN - NCH> $90- YPT add to top plays in $40-50's

Saturday, June 24, 2017 at 04:06AM

Saturday, June 24, 2017 at 04:06AM Added early 2016 as a story earnings play to YPT top plays. China BS crisis hit very soon after and took all growth stocks down >20%. PEN 50's to 40's.

but..

Charts below pounding the table after on it after low 40's - TWTR timeline

$NOW - $JPM initates OW $125PT- YPT added to top plays @58

Saturday, June 24, 2017 at 03:16AM

Saturday, June 24, 2017 at 03:16AM Discovered late 2013 off earnings- 90% and >40% in 2017 as we rinse and repeat earning winners

Hardly a drawdown in past 3-4 years.

YPT Shadowlist play another beat + RAISE " $TYL excellent Qtr/earnings on any metric.

Adding $NOW to list 9:31 AM - 23 Oct 2014

NASDAQ INTERNET INDEX closing in on NCHi- Home of FANGS

Friday, June 23, 2017 at 01:41PM

Friday, June 23, 2017 at 01:41PM NCH- New Closing high 631+