DJIM #37, 2009

Monday, September 14, 2009 at 08:45AM

Monday, September 14, 2009 at 08:45AM So far in September, the daily volume of this market is trending lower than that of Jun, July and even August. The volatility of this market has also been much lower. Of course, we are still early into this month and early into fall trading, but we're just wondering if the lower volume represents a sign of content. In any case, we're in a healthy bull run, volume or not.

We closed at SPX 1041 on Friday. The way it feels, we can quietly reach SPX 1050 and beyond without much drama in the coming days. Also, we are less than a month away from the beginning of another earning season. Perhaps, it's wise to give those recent earning plays another look before they start moving in anticipation of a good follow through report.

In the coming days, we have a string of economic reports which include Empire Manuf. Retail Sales, Housing Starts, Philly Fed etc. Based on the past trend, we are expecting numbers be better than the expectation. However, just like in the past, market reaction will be the key. As we climb higher, economic data points will be digested to see if they are fully reflected in this market's move.

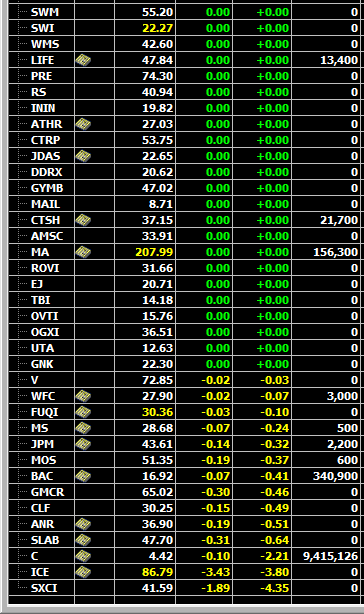

In terms of individual plays, we have quite a few plays that are either at the recent high or are very close to it. You can say that the new high list is also very broad based because even the commodity sector got a nice push last week with cheap dollar. As we said last week, be careful here with commods' as any short term dollar snapback will take away your gains quite quickly.

Here's a thought! If last quarters round of earning was dominated by "cost cutting" and "higher margin", can the up coming quarter shift the theme to "revenue top line growth" and "improved spending"? We certainly think it's a good possibility. It's not that we need to see a huge growth numbers, but anything that give us a hint that things are returning to a normal state of economy will give investors some tremendous amount of confidence. Perhaps then we'd see some more sidelined money moving into this market. At this point, it's still all speculation. The Bears may have a rude upside risk they are not considering at this moment ahead for them.