Accumulation of eco' headwinds = Q3 profit taking..

Friday, October 2, 2009 at 07:58AM

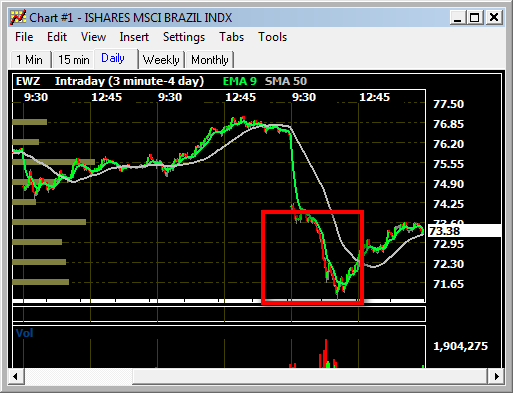

Friday, October 2, 2009 at 07:58AM From the look of the beatings out there, you'd swear, we had a terrible NFP report out earlier today. In any case, we don't think it even matters that much if the job report comes out weak tomorrow. (GS said 250k today and from the employment sub sector of the ISM today, this is very probable). Why, doesn‘t NFP matter now? Based on today's action, we are assuming investors have already written off tomorrow's job report as being "no good". We discussed the ‘headwinds’ and today this accumulated with below consensus IJC#/ ISM#'s and made investors wary about holding into tomorrow. So, everyone might as well sell in front of the event and book gains from an excellent Q3. In the forum today, we noted why not to look for "opportunity" today, we believed no underlying bid would come in and as it turned out, it got ugly into the close!.

In addition to accumulation of eco'"headwinds", today was really all about broad based profit taking after an excellent Q3. We already had Chi’ town PMI indicate ISM probably would not meet consensus. It wasn’t the reason for sell off. It wasn’t horrible enough and say under 50, it was just the accumulation of data coincided with Q3 end which is an excuse to book profits from the largest winners the past 90 days (stocks & sectors).

For some sectors, it was pretty ugly. The biggest winners in Q3 were hit the hardest. It seemed smaller caps fared somewhat better. The plays on our Shadowlist fared pretty good considering the magnitude of the sell-off.

What does it all mean then? Technically, we broke and than closed below SPX 1035-1038 . We noted last week this is "important support". It sets a stage to test the early Sept gap 1016-1018.

So, a bad job report tomorrow may give market participants some more reasons to sell, but we think most of the damage from a bad job related sell-off has just occurred. We are about one week or so away from the earning season. Would we like to buy JPM under $40 a week before their earning report? That's definitely a good setup we think.

Again, investors are wary the past few days as it‘s pointing to a “stall“ in the recovery. Right now, we aren't getting too worried off these Econ. data because we are bound to have some fluctuations ahead in data points. What we think is more important is perhaps a three month average of those data. It paints a better picture if we are progressing or stalling. This is why earnings season is even more important now as all this mixed eco' data might just be 'noise'. As far as selling off in front of an earning season. Frankly, we'd rather prefer heading into the earning season closer to SPX 1000 than SPX 1100. Think about it, if we are actually at SPX 1100 heading into the earning season, we don't think anyone would be willing to chase or hold onto a good report. On the other hand, at a lower level, there's definitely more probability of upside than the downside if we have another solid earning season.

So, here we are, there's plenty of worries this week to cause investors to step aside. In our opinion, we need Bears and naysayers in order to keep this rally going. The double dip camp will get louder now. Skeptical folks will keep things in check and force this market into a technical pullback once in a while. In all, it's very healthy and a short lived correction is the probable outcome.

BIG "IF" tomorrow...if NFP miraculously comes near consensus, the market will most likely show 'opportunity'