A Snoozer

Tuesday, September 22, 2009 at 07:58AM

Tuesday, September 22, 2009 at 07:58AM Despite some early volatility to the downside, the market was generally a snoozer today. Perhaps, no news is just good news at this point. Heading into Friday’s trade, we noted technically, as long as we closed above 1055 it would be a bullish sign heading forward. Today, we found the ever present underlying bid just above at 1057.

Best Sector, tech looked as if it’s done consolidating after 7 days, so we’d look here tomorrow for possible follow through. Of possible positive interest for commodity sec is the CIC (china sov' fund) getting in the resource game with a 850mln stake in Noble grp (commodity trader).

As far as individual play goes, other than a couple of plays such as SXCI FIRE OVTI making a new closing high's today, most plays are in a nice consolidating pattern. What's most likely is going to happen going forward is that we'd see more HITK, DDRX type of pre-earning run up. Simply, we may get better pre-earnings moves than post earnings reports this Q. We have quite a list of plays on our screen at the moment that will undoubtedly have some kind of pre-earning setup.

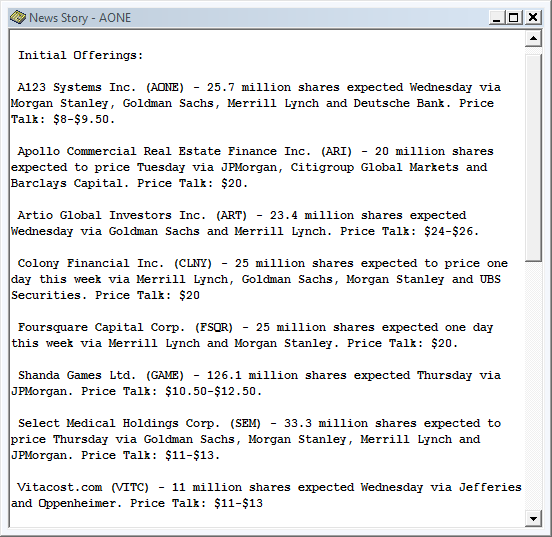

Other than a couple of Eco' reports, the most anticipated event will be the FOMC meeting on Wednesday and IPO‘s later in the week (list below on site). We don’t expect any surprises from the Fed. but we will keep a close look on how they interpret the recent economic activity or exit strategy. This will be closely watched as a sure sounding Fed gives market participants confidence. In the meantime, there's really not much we are expecting from this market other than keeping our eyes on some plays that are poking with recent highs/