Daily Journal subscriber excerpts from rally beginning before 884 ES SPX breakout to another SPX new high 979 SPX cash by July 24th close!.

Our focus : US MID-SMALL CAPS, IBD 100, MOMENTUM STOCKS/ SECTORS, see post below of some stocks heavily played at DJIMstocks.com last Qtr.into this Qtr. (STEC, DDRX, EJ etc.)

July 10th.....SPX cash close 879....

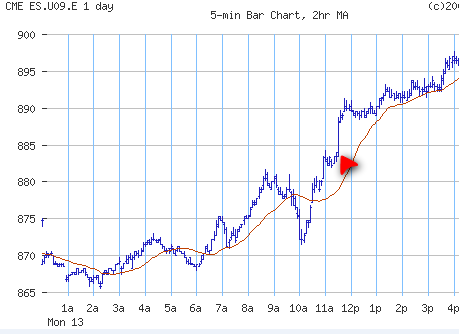

"...The SP futures hovered for hours around 883, watch 884.25 as this resistance area comes with buy stops. This may lead to a pop if busted when re-visited."

Heading into Monday, July 13th trading week,...

"...So far July has been a technical driven market, the storyline should begin to change this week as we hit ‘EPS’ season......Away from the majority coming into this, we think this market will only face ‘green’ when it’s all over with and the market will be higher than where it is now. We are bullish on what might be in front of us. We’ve had a correcting market as pessimism has grown out of a disappointing NFP and consumer confidence numbers recently, we think it’s been a timely correction as this may provide more upside as better outlooks will surprise those doubting a worldwide economic turn is here. The US consumer will eventually come around. "If you build it, he will come", we hear those whispers in our 'Field of Dreams'.. We think many companies misjudged the potential of a fast recovery and will have to improve outlooks. Billions have been added in EM GDP in the past Q with Industrial production leading the way. Companies in the SPX should see this in their top and bottom lines and sectors- stocks with the most international exposure will likely be the winners, notably technology, materials, industrials.....`

"...Let the 2009 summer games begin with the passing of the torch from a technical to a corporate driven market."

As it has turned out most traders living by TA only, got burnt by July 24th!

July 13th close, closed SPX 901....

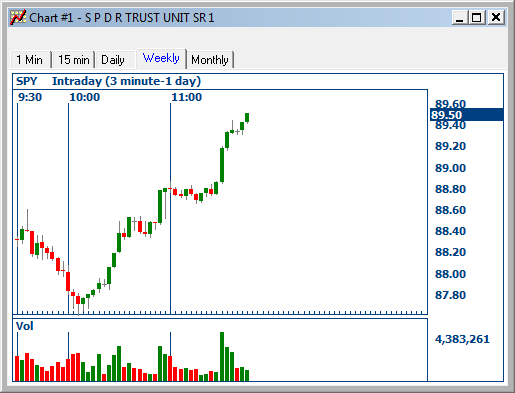

"....If you weren't following our lead and/ or just blinked, you missed the DJIA pop 50-70pts in seconds as these buy stops- covering ignited a market breakout....

Into July 15th, SPX at 905....GS earnings / INTC followed up AH's

"...Howerever, we have to remain open minded as this market can trade in a very emotional way vs. technical this earning season, but the reports would need to continue...

Into July 16th trading day at SPX 932..

"...... Simply, We said we'd be 'bullish' over 900 once again, last 3 days and bull gap pretty well confirms in our minds we hit a summer low at 869. Why? The breadth Advancers/ Decliners, 3 days straight is too good to ignore......Today's action has thrown all TA and just casual market outlooks going forward for a loop we'd think, every short & long TA prognosis seemingly needs to be revised now...... 956 high will fall as long as we hold todays gap /911. Yeah, we're living in a 'Field of Dreams"..so far, so good though since this weekend's reference to it.

Into July 17th....SPX now at 940...

"....We saw other positives earlier (neg headlines..NOK EPS shrugged off, CIT noise again muted) and just before the wire cross (FDX exploding over 200ma). ....We’ve believed one thing and we’ve stuck to not being held hostage since NFP report that brought down the house of green shoot cards and pessimism spread like wildfire..we said starting July 6th…“NFP…only a cautious bump as the world’s economies are not held hostage by one U.S payroll data point. The manufacturing output bounce is still the focus with earnings around the corner to potentially carry weight for the recovery”...... The breadth of the market has been a key to watch on this move, 4th impressive ratio today. ..... if mainstream media-analysts get bullish now, we'll have PA investors jumping on the bed, climbing, chasing the SP names and so who knows how fast this emotional trading takes to break 956. Most importantly here to us is the mood has changed!!

Into Monday July 20th trading day...at SPX 940

"....We've been working on this trend really ever since the TSY news back in late March. This week so far has just reaffirmed that thesis and what happened this past week has reaffirmed our recent thesis that one bad US employment report is not a disaster for companies here while we had a thriving Emerging market.."

Into Tuesday, July 21st trading day...SPX at 950

"...The solid earnings calls keep coming and the SPX keeps trotting along. What else is new?. To tell you the truth, unbelievably the short term outcome of SPX near 2009 highs is of little consequence to us at this stage. Yes, that’s all the investing public is talking about as we close at a SPX‘09 high, we admit to hardly even glancing at SPX, SPY trading today.....Back at DJIM farm today, the drunken’animals were running freely…just yesterday we said…“Even last week, we had past DJIM shadow-listed Q plays putting in new highs at some point ( STEC STAR CVLT EJ )”. Today, we had a few more DJIM shadowed earning stars light up the sky, ( GMCR PWRD DDRX ) for 10-15% and some with new highs. Nobody on the web can be beat that "Fab 7” for a few months now. Also, if that’s not enough, recall in a Journal and later in Forum(06/24) we suggested a pre earnings move will probably come to Casinos after a member asked if it was a time to buy back than. Well, with earnings in a week or so these names...

Into Wednesday, July 22nd trading day & alerts during day, SPX at 954...

Journal title, "BULL ECLIPSE"...

"...of the rarest moment as well. Yes, we are up again and perhaps it's getting a little tiresome? Not a chance! :) The only type of traders who are tired of our current rally are either in shorts or are in cash. In fact, by visiting a few Bear blogs, you'd be able to find a communities of traders who are filled with disgust and anger with this 'Bull eclipse' over their Bear dens. Fortunately, they are the minority at this point, many are just a furball of their old selves and others are in the closet crossdressing as we speak.......Yes, the market has been up for more than a few days too many and we may very well pause here for a pullback. So what? The Bulls are in charge. This current rally is the result of people believing and acting that things are improving from credit to corporate. Yes, the consumer in US is behind, but as recently quoted here, "Build it, he will come".

Alert mid-day....

Later...."Breaking over 956SPX at some point soon, the big difference now to June 956 intraday high is the one indicator we've been noting for this rally. The A/D breadth (advancers/ decliners) line is much better!!. As long as it keeps up, we'll break 956"

..another alert to subs'...Consumers finally playing along today, biggest positive for higher.

Into Thursday's Breakout (956) day, SPX closed previously at 954..

Journal titled, "TACTICAL ORDERS"....

"....By sunset, only ammunition the Bears may have is the Bulls having some trouble penetrating last line of defense "956". In our view that’s a like a military defense in depth strategy gone wrong as it’s delaying rather preventing the advance of the Bulls. Basically, the Bear Front line fell back at our tactical call at 884 SPX futs as buy stops kicked in for longs and shorts covering. Since, the breakout, the Bulls just penetrate deeper and deeper taking no prisoners and just causing more Bear casualties while reinforcing their own forces as seen by the A/D line all the way up. The only thing this recent slow grind in 940’s -950’s is doing, is grinding away at the Bears morale with each passing earnings day. There is no counter attack plan yet for the Bears and the Bull army just needs a signal (one new catalyst) to advance. Only thing that could go wrong is if the Bears can build fortifications here because they are given enough time by some of our seemingly lazy sunworshipping Bulls thinking the job is done this summer!. A slight problem we see here is the Bulls thinking there is some magical “884” repeat before buying in or they are waiting to pullback and reinforce. Put on your helmets now, dammit!. We don’t believe the same buy stops are here at these levels. There's only Bear carcass left rotting up to 956. The "884" was the beginning of the end. That was the ‘Blitz’ this summer and to be honest, we have no plan to ‘occupy’ over SPX1000-1100 for too long during the hot summer month ahead.

Into Friday, July 24th,....SPX hits 979.4 previous day,

Journal titled...A/D Expolsion...

"....Today (Thursday), this A/ D line exploded early. .... discussed the A/D breadth line not to ignore!...

..Bottom line, we'll use the weakness from this MSFT report to gather up some more positions. Also, importantly, if you’ve been on our Bullish posture, which we said below 900 would kick in if we got back above, today was inevitable and sort of anti climatic as we hit 979. Reason being is you’ve should have been making money while the market led up to this breakout, not Performance anxiety chasing to make a buck one day...."

Tuesday, July 14, 2009 at 07:01AM

Tuesday, July 14, 2009 at 07:01AM