Even before the first influential EPS report this week, the storyline started to change premarket to a corporate driven one by MW's CNBC appearance, upgrade to GS-bullish preview of bank earnings. We just said the market must first jump over a hurdle this week with the Banks-Brokers reports and today it got a flying start as it jumped a couple of hurdles at once. This is good as there will be some messy reports from the group upcoming to not let this short covering move get too far out of hand, too quickly.

Still, this was not what really caught our eye!. What was equally or even more important was the market's and groups ability to shake off and not wallow in the CIT unfolding debacle in front of it's eyes. This CIT liquidity crunch has all the potential to remind the market participants the Credit crisis is not really over. Will this giddiness last, will the market continue to brush this off or start to worry about this and/ or other potential pitfalls. As swell as today was, we have to monitor this star crack from becoming a big crack on the markets windshield. Sentiment can change quickly, we just hope we can move forward from the same issues that broke the market before and concentrate on earnings. The market seemed confident in the gov't solving this problem for today.

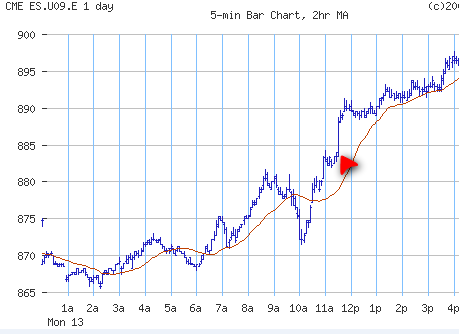

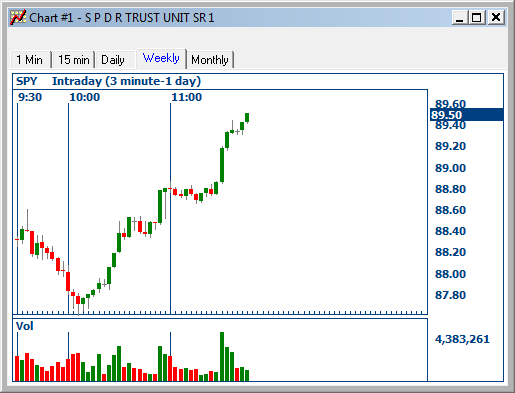

At the open, the CIT fiasco had a tug of war with Banks- brokers news flow, but managed to stage a bounce off lows in the 200ma range. Last week, we pointed out in an alert to watch SP futures at 884.25 levels for a possible rip due to what we saw as a potential kick off of buy stops on a future re-test.

As you can see by the ES and SPY charts (by volume spike) below this is exactly what happened. If you weren't following our lead and or just blinked, you missed the DJIA pop 50-70pts in seconds as these buy stops- covering ignited a market breakout all the way to 901 by close. At 894, we also put to rest the H & S formation for the time being.

Also important today was some individual stock musings (many from our shadow list) that included earnings, upgrades, estimate revisions and contract news to set a positive tone going forward. Some include, PHG for earnings, BBY ROK KFT GOOG upped and/or raised,

DJIM's …GS ARUN PENN LFT raised and-or upped, STEC 28mln contract, WMS (Ohio legislation news), helped it make 10% (low 30's to low $33's) since last weeks alert.

Well, it seems waiting with powder for "July 13th or so" wasn't such bad idea recently. Still, we've got a long ways to go (99%), hopefully, full of good surprises as today.