250 trading days on the wall..if one of those days happen to fall...

Wednesday, January 2, 2008 at 11:00PM

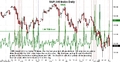

Wednesday, January 2, 2008 at 11:00PM ...249 trading days on the wall! ...yep, the market had a hangover, but we've got 249 to go....Sure the ' Happy' in New Year went away to many a bull today, a day when a chorus line of bad headlines ripped throughout the day. What didn't we get today?. We got a contraction in the ISM number, Semi's got the hammer on INTC downgrade, oil kissed 100 on geopolitical and inventory stockpiles decline rumors, potentially more MER writedown noise came as well. The FED minutes gave some an exit move, nothing more as the swing up was battered soon enough. So, just another -250/50 new skool day, seems nothing has changed from 2007, but then why should it on the first trading of '08?. Market made no resolution to change its rhetoric. Despite the negative tone, the names and niches we've been following here surprised with an effort and a half. This action might just go hand in hand with a nice bounce Thursday from these oversold levels. 'Oversold' is very subjective and differs between many any eye, technical ones as well. The magnitude of a broad move may seem futile as the employment number might keep the easily scared away till after the report on Friday, but we won't be surprised to see one anyways. Either way a potentially big day is in the cards on Friday..up or down. On to the niches that were going against the grain...

Thursday we will see what this late day solar move was all about. We got a lot of noise premarket from supply deals, to guidance, to firms coverage, IBD ink on many a name including LDK, AKNS, FSLR, STP but most of the action that matters came around 320pm as SOLF, STP, JASO, FSLR got a bid into the close. Going unnoticed last week was the Chinese gv't white paper writing that it will, 'vigorously' develop its renewable energy sources, add the oil spike and earnings coming and we should continue to get action here.

WBD had a strong day, including a strong finish closing at 136 at highs of day making it look good for Thurs. VIP, we've noted allowing it to pullback recently before trying another entry. It did as it backed up to 40 last session and closed near $44 today. Throw in MBT in the loop and you can see what we've been talking about the Russians showing resiliency even in the worst of days on the markets.

PBR, with oil making lots of noise, this giant has come to NCH territory at what just might be the right time for some follow soon to the upside. PBR moves well off indices moves , not only when oil is spiking. Another way we'd play this oil job is buying a move off 9ema which has worked very well with quality companies lately. HES, at $98 is a play from that side of the track to look at.

HRBN CMED SDTH noted midday.

MON'santo earnings release before open, keep CF AGU MOS and some POT near by.