..Bullchit' it was!

Tuesday, February 5, 2008 at 11:38PM

Tuesday, February 5, 2008 at 11:38PM The ISM Non-Manufacturing index was unexpectedly released ahead of its scheduled time this morning, with the Institute of Supply Management citing a "possible breach of information" ahead of the release.....

Who breached?....this was to save the mkt from intraday (morning) panic as far as we were concerned!....well. .okay maybe we can start to understand if some guy spewed the number to those Mexican reporters after the Super Bowl after a few too many;). Yeah, you know to the one(s) from TV-Aztec with the Tom Brady wedding proposal ....

A lesson on ISM, if you've never paid attention to it or cared much for it, you will now ......Europe had a bloody one and it just followed up here with CNBC masking the importance of it all morning it seemed. This is supposed to twitch 1 or 2 pts from each report to the next... today it went epileptic, whichever way you read it...new or old way.

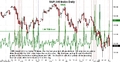

As you know, we've turtled ....luckily ahead of all this as of Friday and we'll stay that way. Hopefully, you are with us and have come to understand the importance of capital preservation, if not before..well then the past few days. Trading is not only about being in the right plays, it's about having having money left to get in the right plays in a better market. This is capital traders might start to use, if we start a bounce off the 50% retracement off last weeks highs at some point soon in some of the indices. We'll see, hopefully there is a catalyst that comes with it and not just more techincal mumbo jumbo to create a move. 1335 on SPX, if we remember right, is one to watch. Who'd thunk it!, we'd almost be at 50% retracements in a few trading hours after the fast move up. Sincerely...be quick if you want to play this way, its only 50% more to the most recent lows. That's not a whole lot is it?

Demi/ YourPersonalTrader

Demi/ YourPersonalTrader

Jus' a follow up to yesterdays note for those not familiar with TRIN readings.

We wouldn't be shy about selling anything you still want to rid of if this comes to fruition.

* besides ILMN closing well, we'd keep YTEC around for a potential buy after its post earning action yesterday, preferably on a dip