Heading into the busiest corporate reporting week, we said, ‘Goldman who’ and who cares as we’re only thinking of the reports on deck. As of late afternoon the market showed this ‘Elliot Ness’ hunt reaction was overdone as the market recouped every SP point from 10am Friday as this correction looks like a blip of 2.6% off highs and nothing more as money came back into high beta stocks. The real problem is the potential tremors and pressuring of financial regulations to pass, but, we can’t dwell on what may or may not happen and deal with what is given by the market and now it's EPS's.

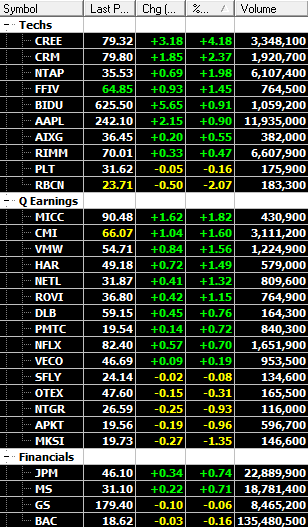

Now, is clearly the oppy to trade ‘surging ‘ corporate profits on a selective individual stock basis. The problem, if you want to call it that… is how will the stock react and if the initial spike is worth a chase or not????. This pertains to most traders as we all like a good quick buck by being in early on a stock. Whether, if it’s for a ‘hit and run’ intraday trade off an EPS or in a discovering a stock early and being one of the first on board and than leaving with nice profits when the herd comes in late. Also, after an initial spike 7-8% like we saw in EDU, MICC, ATHR today, we want to be in the first day because most times these spikes enter a phase of digestion, consolidation and so you may not get fast money again for awhile or we may even get a valuation downgrade the next day(s) after spikes of that size.

Unless some under followed stock blows the cover off the ball and is an easy trade, we‘re in for a difficult beginning in analyzing what will be the ‘reaction’ after the bar was set high by the ‘ best ‘ of breed last week. What we saw today, we can’t complain about as small caps outperformed any well known stock if you take them at equal weight on how good the reports were. A few things we know is big familiar names are much more prone to sell on the news as they are widely followed, we know the bigger the market cap, institutional support the smaller the % gains probability. We also know some sector names will react in respect to health of the sector at that time and of course float matters when we get into mico-mid caps later this season. Oh yeah, the 'sexy' factor will matter many times, if you wanna get lucky.

A look through reports today and we’d have to say the best reports/guid were from 2 industrials (PH ETN ) as far as the ‘headline’ reads, but they had the same reaction as the bigger names since Friday, which is an initial good open and then a sinking feeling within the first hour that lasts all day. PH did exactly what last report day produced and the point here is keep these listed for later because you can see what PH did after. We had a typical ATHR reaction we should all know since we started to cover this stock last year, a gap and than dead silence which could go on for days or weeks considering how much it gapped. We had a head scratcher in EDU , which a produced a gap and than another intraday run (which is the perfect trade..eh). The EPS guidance was inline and you’d think this one was prone to sell off even off a great report because the run into the report was already mind-boggling. MICC , a stock we added back last Q off report acted perfectly, a gap and run. If you’re familiar as you should be with these last 3 names off our Shadowlist over the past years, all in all …they all acted as previously, even EDU from experience since it IPO’d and became a DJIM stock. We also know tomorrow it can be brought down fast. lol. So... the game ain’t that easy, but in the broad market we are in a better position to profit off reports as we trade a lot of the under followed and not so widely followed.

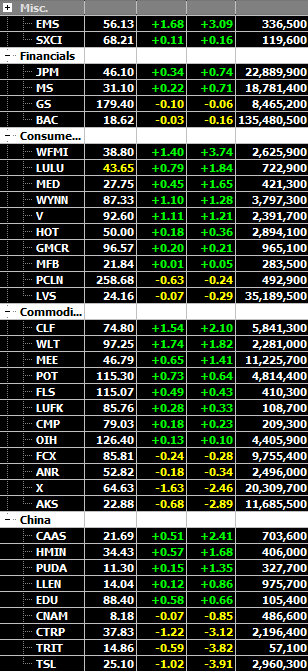

AMC, ignoring the market anomaly of a stocks called AAPL, the best 'headline' report was out of TUP, yes, we said Tupperware. After today’s reaction, we’ll follow this one as from previous reports we know it can really run the next day..on the other hand, it can do nothing due it’s ‘not-so-sexy’ factor and fall into the PH ETN camp.

Wednesday, March 31, 2010 at 07:18AM

Wednesday, March 31, 2010 at 07:18AM