Is this the "everything is going fine" melt up we’re witnessing on the back of solid NFP# / global PMI‘s from last week and today‘s ISM non-manuf‘ & Pending home sales? Is this the same stock market we've been playing day in and day out since early last year? The more we ask ourselves, the more uncertain of an answer we'd come up with. Cast aside any personal opinions and too much analyzing, this is what it is…the market is still very resilient, investors are favouring risky assets, especially on any shallow pullbacks and that is all that matters. We are at SPX 1187, up over 500 points from the low we hit early last year. If memory serves correct, the pace of this bull market will slow down dramatically, just like in the other bull markets of the past. Of course, knowing that the pace will slow down and knowing when it will slow down are two different things.

Our speculation is that sometime during the coming earning season, the pace will slow down. Possibly a May sizable correction coinciding with the “Sell and go away in May” almanac trading mentality returning as things have gotten back to normal. Right now, market has risen to a point that a lot of positive things are expected for this quarter and beyond. You can also say that some of the price movement from some of the plays on our list may reflect all of the potential good things in them. Does this mean the end of the bull run is near? Hardly! First, we have merely gone from being really undervalued to somewhat fully valued. This is also a big if because we can't generalize everything in this market as being fully valued. Some companies, given the current environment and their prospect, may still be "cheap" if they can capture the growth opportunities. Here's the thing, not all of the companies out there are in the same phase of this Economic recovery. Some companies have indeed been recovering, like many commodity plays, from the slump in demand over the last couple of years. Other companies, such as those in technology sector, are having the kind of growth they've never seen in their history. In other words, recovery or not, some companies are seeing their business at the best level despite the fact we are still sitting at a "cough" 9.7% unemployment rate.

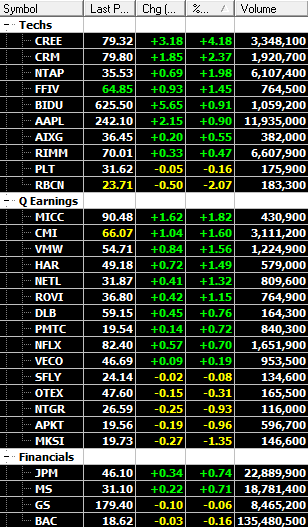

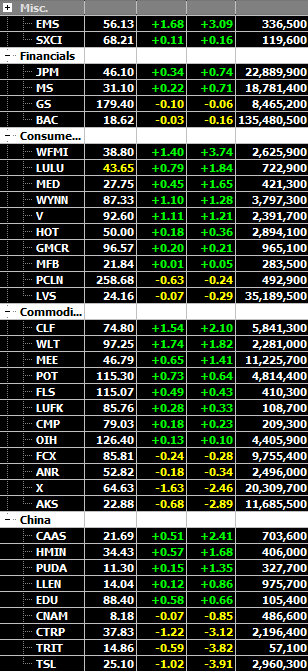

Here's the thing though, it looks like we are playing both the recovery and growth theme at the same time. In our opinion, it can probably only get better from here. Today's action is simply broad based and led by familiar DJIM shadowlisted plays hitting new highs, outperformed with R2K the other major indicies. The semi LED group ( RBCN CREE VECO AIXG ) being the strongest, as well as gaming stocks ( WYNN LVS ) and our favorite X CLF WLT commodity linked plays all taking on some nice gains throughout the day. We are talking about mostly EPS winners that have made it to our list in the past, econ. sensitive material stocks and as well as consumer discretionary gaming stocks going up all at once. It truly is a bullish feeling out there.

However, although we broke out of the recent high of SPX 1180 and closed at a new fresh rally high, the volume is somewhat disappointing, but the majority of world markets were still on holidays. We can only conclude that many longs are just holding that much tighter to their holdings, in spite of recent gains. Again, sometime this earning season, we may able to see if people are willing to lock in some profit before the lazy summer hits.

Bottom line, we definitely started the week with a bang. The question is, can we keep this going...

Wednesday, March 31, 2010 at 07:18AM

Wednesday, March 31, 2010 at 07:18AM