Happy Holidays! It's our pleasure to write journal #52 for another year. Like in the past, it's always an emotional thing to look back the past 52 weeks and sum up our year. We have to say, not many other professions can give you the kind of emotional roller coaster this gig does. If you are still trading and having fun doing it so, then you should consider yourself a true winner in this profession.

What a year it's been! "Only if we knew....." It is somewhat silly to say "had I bought these many shares of XXX stock at XXX month, I could've taken the next few years off". What is done is already done and there's not much we can do about that. What we should be doing though, is to reflect upon our own trading action and see if there's anything we can do to improve in the future. For DJIM, after many discussion among ourselves, we felt the biggest shortcoming for our trading strategy in 2009 was the lack of aggressiveness. Ever since we saw the turn back in March and started playing the bullish stance with this recovery theme, we have been handicapping ourselves for not being more aggressive in our strategy. It is true, we have never dealt with a situation like this in our trading career and it's a great learning lesson. However, we still feel that we could've done better to adapt to the ever changing trading environment.

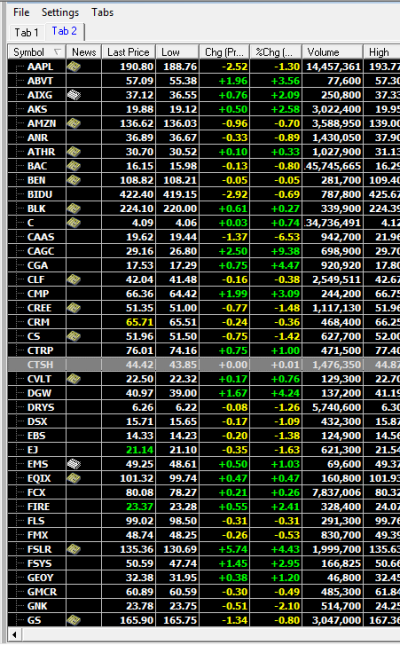

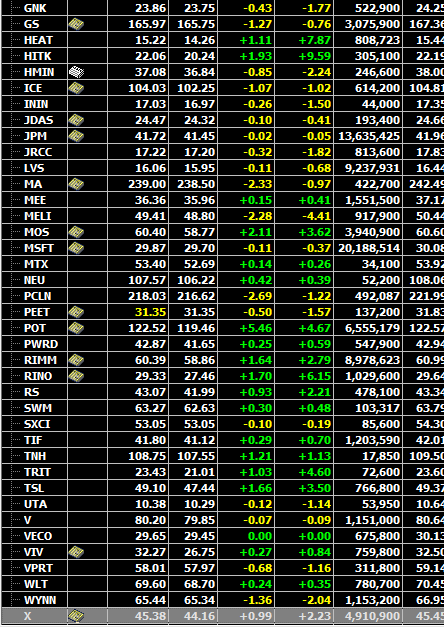

The biggest change that took place in 2009 at DJIM is the heavy involvement of mega cap and big cap stocks. For those of you who have followed DJIM since few years back, we are always known for picking the small cap winner at an early stage. However, given the lack of opportunity in small cap land and ferocious action in the big cap land, we were forced to put much of our focus on the bigger stuff. The thing about trading the bigger caps is that it requires patience. Toward the second half of the 2009, we started mixing our portfolio with bigger and smaller stuff so we can take advantage of both world.

Coming into the last week of trading in 2009, we are sitting above the recent high at SPX 1126. Although last week isn't exactly a good indication of market direction due to the lack of players(DJIM included), we'd still take the good close as positive vibe heading into the new year. Last week's action was all about technology stocks. This is a good sign to us because technology stocks are all about growth. Hopefully, this trend can spread into other sectors where growth can be found. Right now, we are very comfortable with the kind of play selection on our shadowlist as they give us a very good idea about which sectors are outperforming. As far as some of the Chinese plays lagging the recent market rally go, we feel it's a matter of time before they catch up. This market does tend to rotate among sectors and as long as the plays aren't fallen off the radar, they are still in play.

Next week is another short trading week but we feel more players may come back to "check" on their portfolio. We won't be surprised that the recent breakout get challenged and we get some mini back and forth action. All in all, we do expect a quiet week before the real trading starts in new year. At DJIM, we'd take our time and look through the individual play in our portfolio and decide which plays to be lightened up and which plays to be added.

Monday, December 7, 2009 at 07:51AM

Monday, December 7, 2009 at 07:51AM