..as sloppy as it gets

Wednesday, October 21, 2009 at 07:58AM

Wednesday, October 21, 2009 at 07:58AM If you missed today’s premarket and the bullish reports from AAPL and CAT , you missed the highs of the day!. Expectations of a push over SPX1100 on the heels of those reports didn’t materialize and the failure to do so makes many take some off the table.

As many scratched their heads and /or pointed to the U.S eco data points as the reason for the tepid start after the opening bell, we were shorting Brazil’s ETF and a few of their stocks …“Tomorrow, look for weakness (short term) short opps' in Brazilian stocks/ indicies due to a 2% impose on capital foreign inflows in an effort to curtail Real`s lift and prevent bubble in their mkt. Wait to see if this materializes and becomes a noisy issue and spreads as a Global issue. The short term idea here is US inflows have sustained Brazil's Equity markets and this logically can't make many happy.” .

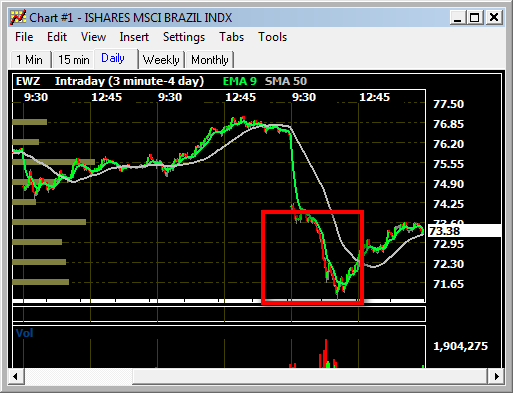

below: EWZ mid morning swoon.

Simply, these actions would have FX implications and big money knew this would spread to a global issue as the USD would strengthen and push US markets lower. Surprisingly or intentionally, Briefingcom didn`t even run a story till about 11am and than we saw a big swoon in EWZ (volume spike) as traders piled in and US markets fell as the Dow lost about 70 points quickly back to 10k. You can easily see the correlation of EWZ and US indexes on a chart mid morning. As said, this is a short term trade opp`and we used the added weakness after the stories ran to exit as you rarely see 6% drops in any country's ETF in a day. Even if this is an unprecedented act on equities by Brazil, we don't expect this to be a big noise for USD going forward, but who knows. This act may have other implications or further acts may arise depending if it works or not...so the story may have some noise left in it.

Anyways...the day can be summed in a few words.."sloppy and disappointing" as it relates to pushing above 1100 in the very short term. We have to wonder what it would take now to get over this wall as we are running out of AAPL and CAT's. Maybe MS WFC can bring the financials back from recent underperformance and market react positively. Otherwise, watch the Sept peak of 1080 (1079-1075) gap more intently now.