C as in "Crumble"

Thursday, January 15, 2009 at 07:33AM

Thursday, January 15, 2009 at 07:33AM You can also use the word "Collapse" or "Creamed" to describe today's ‘world’s’ market. Besides European bank fears DB -9%, warned, HSBC -8% capital fears. In addition, C (-23+%) , which is also the ticker symbol for today's big Culprit in US markets, Citigroup. So, the way people have been interpreting Citi's restructuring come earnings is negative , everyone feeling that there's a very likelihood it's going under no matter what it does. This is, at least true with the common stocks. Basically, Citi is the nucleus of market worries that caused Tuesday‘s chop, slop into a mudslide crashing through 860SPX. Of course, we also had the dreadful retail sales number & failures, foreign downgrade ratings , NT filing for chap 11.... to blame on the market decline. It’s just becoming a flood of the ‘bad news’, we discussed at DJIM once the gag order came off in January.

Here's the truth! We broke SPX 860 cleanly and we are now turning to SPX 820 for support with DJIA 8000 not far away. It also confirms that the rally started in December was nothing more than a typical bear market rally as we’ve discussed recently. Today's market action was pretty intense with uncertainty in Washington TARP-Stimulus-Geithner picking up steam and helping to sicken the markets. There was no letting up of even a minor intraday bounce. You can tell that institutions are selling heavy and putting a lid on every rally attempt. Even watching from the sideline, we can feel the intense selling pressure. VIX, the volatility index, shot up to 50 and that's something we have to be very wary of. Why? Today's the first day in the last few weeks that looked a lot like a typical day in last November. Coincidentally, back in November, the market was all over the financial companies as fear of collapsing banking system runs rampant. Today, to a lesser degree, same fear is back and action is just oh so similar. Intraday swings are more likely to return in this environment..up and down.

There's no safe heaven out there. We are also putting off "buy on weakness thesis" for now. The market may rebound tomorrow, but we are not playing cute this time. JPM is set to report tomorrow and Citi is going to report the day after. Market reaction on these two behemoths is very crucial. Basically, we feel SPX 820 hinges on the well being of these two earning events. The best bet right now is continue to stay neutral and on the sideline. This may be a "coward" way to approach this market , but we feel this is the best strategy when your own hard earned money is on the line with every trade here. Regardless what happens though, we still like the way market resolved any issues with quick and decisive action in the past. We may go much lower or stop right here, we'll know the answer within a couple of days. By then, we'd know what to expect from this market and which plays to look for.

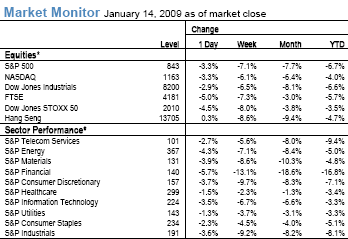

A muddy start to the year (below)