Torn again?

Friday, October 30, 2009 at 08:14AM

Friday, October 30, 2009 at 08:14AM When we said a few days ago the market awaits GDP, Homebuyers credit resolution for direction, little did we know it would become seemingly ‘skitzo’. The GS whisper # ran the market down and the real # pushed it back up. Oh yeah, make sure you relax this weekend and get your anxiety levels down if you thought it was October 2008 all over again. Why?…if you thought these last few days were whacky, wait till next week as we have FOMC meeting tweaking language game and NFP employment report to deal with!.

Simply, the game has changed from earnings reads back to economic data and we actually welcome this change. Lots of noise of Bears about the GDP 3.5% surprise was the ‘clunker’ aspect to it, well, our Bull noise is remove the ‘clunker’ and the economy paced at 2.5% GDP. That’s just under GS # 2.7% overall, take out ‘clunker’ and their number would read as 1.7%. Get it ? 2.5% vs. 1.7% is a surprise and the market reacted.

One thing the GDP/ HB credit tax bill should do till next week’s noise and probably did today was show relief in the market. It definitely provoked a huge squeeze on those overzealous Bears who became to eager pressing the market lower from 1070 (recall huge volume post here) and another at ~1060. As we said, any short damage was done by GS whisper # with many TA intertwined channels/ supports in low 1040’s.

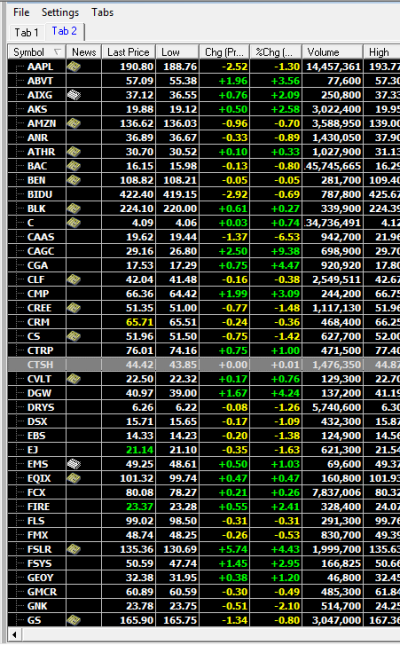

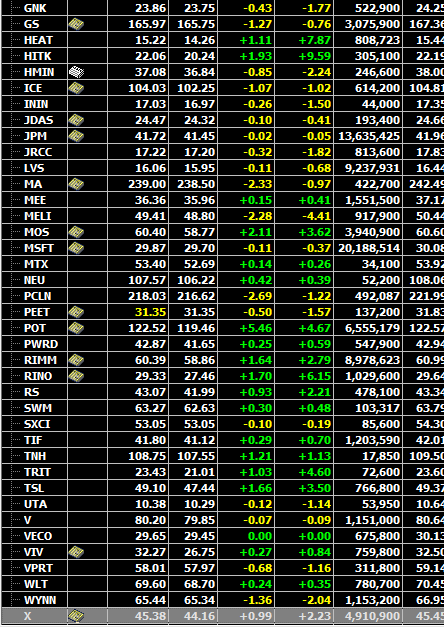

Once again, the market showed “it’s no different this time“. But, only to a point so far. meaning the market has the ability to reverse easily. We don’t think this was much of long only underlying bid coming back, but instead a squeeze. The sellers this week did not all of a sudden turn to buyers today. Why?. Well, it was mostly an ETF led rally as individual stocks of importance really didn’t do much. Yes, DJIM’s list had some big gains ( mostly stocks under $10-20, eg China stocks and commodity linked stocks moved to the USD game), but after the beating for a few days it’s hardly anything to get excited about here as they are nowhere near the prices from last week. So, as we noted yesterday, we think a bounce will be more TA related and protecting gains will be the resistance to higher high’s. Of course, this may change if we get positive catalysts from eco data points in days/ weeks ahead.

After today's action/ GDP, we can only say investors remain will be "torn again" between a desire to take profits and reduce risk into year-end or risk missing potential upside once again off a GDP suggesting positive payrolls early 2010 or even sooner!

Let’s not get ahead or too excited, we are still down quite a bit on the week and face a long week ahead. One thing we hope for is a few sector plays emerging to takeaway from all the SPX stuff. AMC, we posted Casino’s, our DJIM list includes..LVS MGM WYNN (LVS was low 14’s post time and closed in low 16’s after some ‘bottoming’, group business coming back noise) and CLF, which posted a ‘clean’ eps and gave strong guidance, bullish outlook for iron ore volume, which is also a positive for integrated steelmakers.