..dime action?

Friday, September 25, 2009 at 07:32AM

Friday, September 25, 2009 at 07:32AM What all traders know from early September is this market can stop and start on a dime.

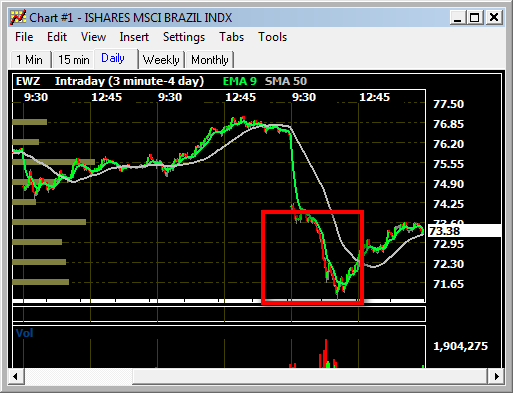

Beginning of September this Bull run was seemingly losing steam (losing 3.5% from H to L). In the middle of this dip, we talked about Bulls not coming in/ providing underlying bid until things settled down, especially after a 2.2% drop in one day. Also, at this point we talked about the Bears missing an opportunity to press the Bulls to their knees. Seemingly, we could be in the same pattern. It’s seems too predictable now, but the shorts have this as on upside risk always shadowing them. The ability of the market to stop and start up again is there once again. Right here and now is probably a great opportunity for such to occur soon. Why?. This dip has given an opportunity for money managers to dress up their books as we’re coming into Q end and they might be foaming at the mouth. The start of Window dressing may just bounce this market very soon.

Still, this action is reminiscent of the action prior to AA earnings last Q. If this is the case 1035 is a possibility (because we closed below 1055 today) before AA’s earnings in 2 weeks, but it doesn’t curtail a reversal possibility before. Understand though, we're not talking a bounce of 70-80pts here like last time!!. Use reversal if it comes to lighten up existing positions and/ or just get your daytrader face on for the time being.

Takeaways from todays’ action

IJC# was positive but was nullified by a negative housing number. Strong USD pressuring commods’ and not helping bounce opp’ for risk assets such as equities.

Volume was heavy, but it was confined to the SPY and sector ETF’s, even in the continued sell off to 1045 there was minimal damage to the majority of individual stocks as many < 1-2% down on our list. Might be a positive. Individual stocks taking a licking are more of the momo type (casinos) and/or garbage stocks with bigger profits to take off the table.

IPO’s, we ignore the REIT IPO's, we all know this is crowded/ garbage space. Instead, we look to one we highlighted AONE and the spectacular day it had. The offering and size was raised (positive) a few times and it still managed to get a herd into all day pushing it higher. This is a positive for the market's mentality going forward. Still, all the new issuance's and follow on issues hitting the market puts the market in a posssible digestive mood again, keeping 1100 out of reach for the time being.

RIMM, judging by ES action tonight the market may shrug this report off and may signal a bounce begins from 1048.