Exerpt

INTO THE TRADING WEEK, 5.12.16

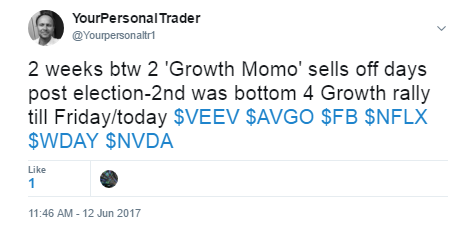

The unwinds and rotational trends continued last week, notably as growth took a 2nd leg down...

A 2 week rebound unfolded after 1st sell off. Most growth stocks including FANGS took a beating and were off 5-15% on the week as value outperformed growth. The NAS100 was off 2.65%...

The SP500 value to growth ratio has retraced 50% of the Value underperformance for the past 3 years and should stall out here and growth to stabilize.

Nasdaq 100 should help out by stabilizing at 4600-4700, SOX at a channel ~823. This should also coincide with consolidation in Financials/ Industrials in the near term and money to be used back in growth to close off the year.

The LT bull trend in growth is not going away due to a month of breath-taking rotation all over the marketplace.”

NDX CHART

YPT Shadowlist of 80 stocks is tailored and fragmented (outperforming SECTORS, SMALL-MID CAPS, EARNINGS/ GROWTH (EPS) linked stocks, IBD 50, MOMENTUM STOCKS) to gauge single stock action and the broad underlying market for SP 500 direction to go long or short. New plays (stock/sector) are added, especially during earnings season.

Wednesday, June 28, 2017 at 01:20AM

Wednesday, June 28, 2017 at 01:20AM