After +/-5-8% monthly moves in the previous 5 months, October looked like a walk in the park for the market, especially since mid-month, stalling out as the broad market was taken hostage by QE2-elections. Well, the release of hostages is set for next week and seemingly the consensus has been it will end in a “sell on the news”, even 'bloodbath' scenario to some because of the substantial Sept to Oct market run putting the market back to it’s 5-8% monthly swings. Of course, the ‘fatigued’ 2 week stall state is just asking for (trouble) anything less than expected to spiral the market downwards, but if we get status-quo expectation revelations, this may likely turn out to be a non-event (yet choppy) and therefore, not necessarily sell the news event(s).

Despite, the broad market tied being tied down mid month, the coinciding earning season has provided plenty of oppy's to trade the reports. Heading into the mid month earnings, speculated here ..“..selling TSY’s is probably underway`…rotation/liquidity into stocks from Treasuries is the natural course….It actually might not be as the market remains steady because individual groups get enough liquidity to sustain it...". As you can see by the charts this occurred and coincided perfectly with individual earning stories -linked groups getting the money flow. The overall better than expected earnings that haven't moved the broad market higher, may just be a pause until QE2/elections are out of the way, at which may point the market will begin to look towards 1H/2011 with a rosy outlook off these earnings and stabilizing eco' data that we've seen most recently. The market is also going to get the first important October end Q reports from CSCO in 10 days that may coincide with recent eco’ data to paint a better overall picture going forward. Before, we get China PMI out by Monday morning, NFP print comes end of this week.

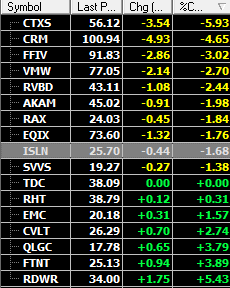

So far this 'strong' earnings season, highlighted the fact ‘headline beat earnings’ were getting very favourable post reactions and this streak continued as stocks gapped, but still had room to roam with CML, FFIV as prime small cap examples this week. Unfortunately, this streak ended with FSLR`s report/call and caught all solars and one of the best Q beats /best accelerating guidance calls this Q in PWER with it. This was probably 1/100 odds type of reactions, especially after a stock already trades higher AMC and BMO the next day. Group reaction is similar to the EQIX small rev' miss and subsequent sell off on all Clouds-Virts that turned out to a hiccup. Double top probably played some role as well and-or it's just a dirty AMEX -like stock. One thing to remember is, if you don't know a stock/ what group it belongs to and/or never traded it before, it is best to begin with a `starter` position if chasing a headline number. On the other hand, if you always trade on your heels and don't go big into huge beats, you miss excellent oppy`s in the CML types, who's reaction is usually what you get 99 out of the other 100 times and/or one like FTNT recently that had huge upside numbers like PWER and you miss not only the earnings buy in, maybe even M&A possibility…AMC, reported FTNT was in advance talks with IBM. ..“..FTNT an add here at $18 before it was discovered as a play in the space anywhere, showed something many can't and that is accelerated growth. It's potential takeout price just zoomed to over $30 on this report“.

Monday, October 11, 2010 at 02:54PM

Monday, October 11, 2010 at 02:54PM

Demi/ YourPersonalTrader |

Demi/ YourPersonalTrader |  Print Article |

Print Article |  Email Article | tagged

Email Article | tagged  CVLT,

CVLT,  EQIX,

EQIX,  FFIV,

FFIV,  RAX,

RAX,  RDWR,

RDWR,  RVBD

RVBD