Every day this week, DJIM highlighted the importance of ‘Jackson’s Hole'. This was in order to take everything else with a grain of salt Monday to Thursday. This was the potentially a ‘catalytic’ event as the market had been mired in confusion since being caught off guard August 10th/FOMC.

Today, Bernanke heard DJIM and market cries for a ..'Oscar' catalytic performance”…”.. Bernanke pulls a rabbit out of his hat…” Hell, we even almost begged heading into the address…..”Please, Ben”.

The only thing to watch as the address became public was to see the camels back get broken ($TNX ) to understand the market’s approval of the address. It was a thing of beauty as seemingly the stars aligned from premarket…a GDP, not close to whisper # under 1%, but 1.6%, a beautifully timed INTC warning to smack SPX 1040 again in heavy selling. BTW. This was in play here at DJIM before all the downgrades, CSCO news began in August, so this was hardly a surprise and the real money bought it up or covered fast most likely, ”(signs of technology softening demand is showing up globally (possible correction in technology coming)”. This tech correction is a thing in progress and will last into Q4, so it’s not the end seen today just because INTC/tech rebounded hard and/or found a long lasting bottom.

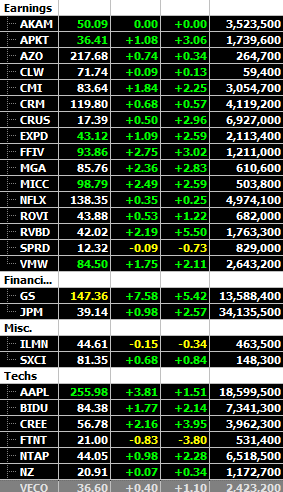

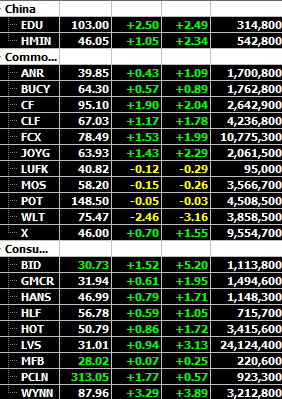

Back to TSY, the real mover of the equity market!!. As alerted at SPX-1257,…”...Just watch the $TNX heading into Tuesday's gap, Ben blew them out today.”. Market was thinking 1060SPX, this weeks “R” was going to be it for this leg. DJIM thought differently as there was no evidence in the market internals in stopping the market till 1065 as printed here this week as “R“. Yep, right into the middle of early weeks gap 1063-1067. Most importantly, watching the TNX, which only improved some more after a 5% steep morning move, solidified we’d head into the gap and that there would be no ‘usual’ late day selling. Add the “something missing" from this week ...metals snap backed this time…FCX +6%, steels 4-5% and you get the drift why 1065 was possible.

Away from all the broad market hoopla, the real ‘fun’ was in small cap fever as in past years with speculative big bids entering a few plays. On the 20th, alerted an unknown stock that was not in traders minds as a play off MFE/INTC deal. But, slowly and surely the past week, you could see the accumulation of shares in FTNT as some got wind of how ‘good’ and relevant this company is. When ARST got rumoured for a $40 takeover Thursday, FIRE joined the fracas and FTNT popped quietly up while under radar. Today, it was accumulated early away from all the broad market hoopla and eventually exploded to a high of $21.70 from an open under $19.

Even NZ, off blowout earnings…(revs came in $63.8MM vs. the St $54.27MM,· EPS came in .09 vs. the St .06, we are increasing our guidance for the full fiscal year to approximately 30% annual revenue growth ), popped another 7% from alert with crazy bids coming in and out. As all attention turned to POT recently, the real M&A play has been off the circus surrounding PAR, which has brought out momo/speculative trading in small caps. Cool.

So, the question is today ‘the’ turning point?. In all honesty, it’s irrelevant as long as there are spots to trade in this market as has been the case even through a recession. We’d like to think the Bulls have reclaimed home court advantage finishing at ~1065, but, next week we’re going to deal with China ‘PMI’ and US ISM /payroll to seal the deal or not. What needs to happen is a return to calmness amongst investors and see real money/conviction come in and push nicely over 1065. Bernanke may have started the ball rolling in accomplishing this. If not, today will only be classified by next week as a ‘short covering’ and those taking a rental out on the market for 2-3 days. It’s great Bernanke spoke positively of 2011 and almost promised the ‘world‘ to fight (with conditions though) but, we’d be silly not to worry still about the rest of 2010 and possible retrenchment by businesses because of recent macro data, which would equate to a recession all over again with monetary accommodation or not.

Wednesday, August 25, 2010 at 07:03AM

Wednesday, August 25, 2010 at 07:03AM